Rios Co. is a regional insurance company that began operations on January 1, 20Y2. The following selected

Question:

Rios Co. is a regional insurance company that began operations on January 1, 20Y2. The following selected transactions relate to investments acquired by Rios Co., which has a fiscal year ending on December 31:

20Y2

Feb. 1. Purchased 7,500 shares of Caldwell Inc. common stock at $50 per share plus a brokerage commission of $75. Caldwell has 100,000 shares of common stock outstanding.

May 1. Purchased securities of Holland Inc. as a trading investment for $126,000.

July 1. Sold 4,500 shares of Caldwell Inc. for $46 per share less a $110 brokerage commission.

31. Received an annual dividend of $0.50 per share on 3,000 shares of Caldwell Inc. stock.

Nov. 15. Sold the remaining shares of Caldwell Inc. for $51 per share less a $90 brokerage commission.

Dec. 31. The trading securities of Holland Inc. have a fair value on December 31 of $120,000. 20Y3

Apr. 1. Purchased securities of Fuller Inc. as a trading investment for $125,000.

Oct. 14. Sold securities of Fuller Inc. that cost $25,000 for $30,000.

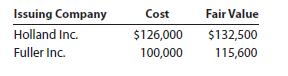

Dec. 31. The fair values of the Holland Inc. and Fuller Inc. securities are as follows: Issuing Company Cost Fair Value Instructions

Instructions

1. Journalize the entries to record the preceding transactions, including any December 31 adjusting entries.

2. Prepare the Trading Investments section of the December 31, 20Y3, balance sheet for Rios Co.

3. How are unrealized gains or losses on trading investments presented on the financial statements of Rios Co.?

Step by Step Answer:

Financial Accounting

ISBN: 9781337913102

16th Edition

Authors: Carl S. Warren, Christine Jonick, Jennifer Schneider