Below is a note from Eastwood Ltd's recent annual report: 1. Summary of significant accounting policies on

Question:

Below is a note from Eastwood Ltd's recent annual report:

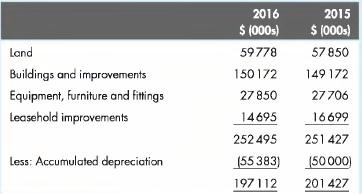

1. Summary of significant accounting policies on non-current assets Property and equipment - Property and equipment is recorded at cost and depreciation is calculated on a straight-line basis. Buildings and improvements have an expected useful life of 15-30 years, while the expected useful life of equipment is 4-15 years and furniture and fittings is 5-10 years. For 2016 and 2015, the assets included in property and equipment are as follows:

1. If Eastwood Ltd did not sell any property and equipment in 2016, what depreciation expense would have been recorded for 2016?

2. Assume that Eastwood Ltd did not record its depreciation expense in 2016. What is the effect of this error on the following?

a. Profit

b. Current assets

c. Non-current assets

3. What was the cost of the land purchased?

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson