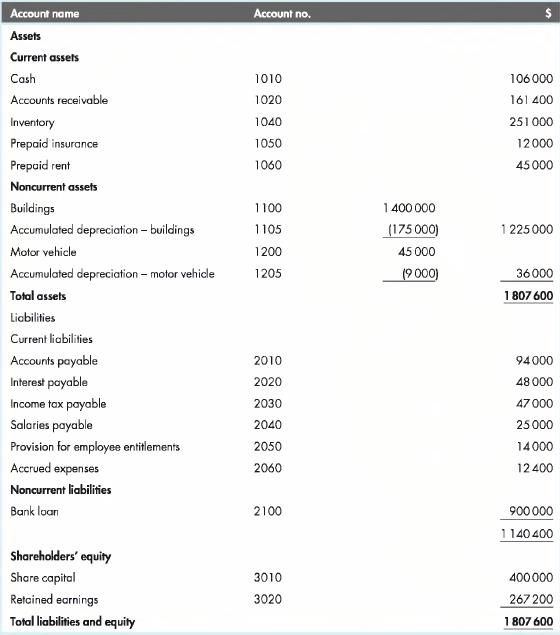

Psyche Books Ltd is a bookshop specialising in psychology textbooks. Psyche Books has the following balance sheet

Question:

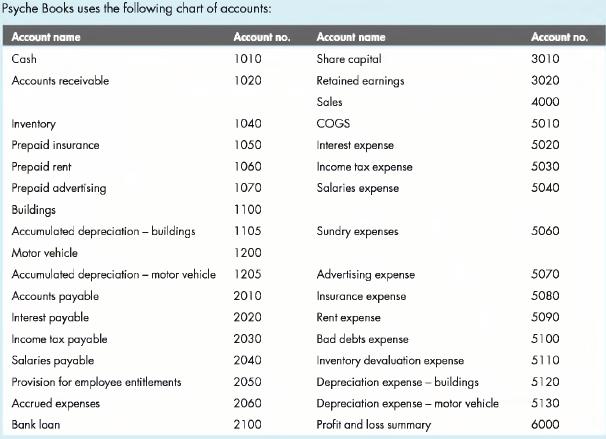

Psyche Books Ltd is a bookshop specialising in psychology textbooks. Psyche Books has the following balance sheet as at 30 September 2016:

Additional Information:

1. Psyche Books uses perpetual inventory systems and all its textbooks are sold at a 30 per cent mark-up.

2. Buildings are depreciated at 2.5 percent p.a.

3. Motor vehicle has a useful life of 10 years and is depreciated using the straight-line method.

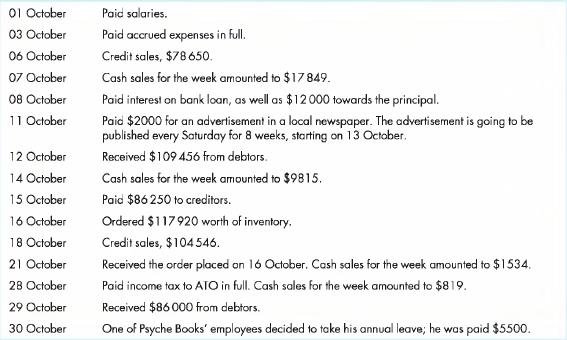

The following events took place in October 2016:

At the end of the month the following events occurred:

Some of the stock of Psyche Books was recorded at $5000 but was established to have a net realisable value of $200.

Interest on bank loan accrued at the end of the month is $46 000.

Depreciation was charged to the buildings and motor vehicle at the end of the month.

Monthly rent for Psyche Books' head office was $5000 and is payable on the first of every month in advance.

e. Prepaid insurance was originally for two years, purchased on 1 January 2016.

f. The company policy is to keep allowance for doubtful debts at the end of the month equal to 3 percent of total credit sales for the month.

g. Owed salaries at the end of the month, $22 500.

h. Electricity charges for the month are estimated to be $2760; phone charges for the month are estimated to be $8900.

Required:

1. Prepare journal entries for the above transactions.

2. Enter the opening balances in the ledger accounts and post the journal entries to the ledger.

3. Prepare a 10-column worksheet.

4. Prepare and post the adjusting entries. Enter these entries into the worksheet.

5. Prepare pre-closing trial balance at 31 October 2016.

6. Prepare closing entries.

7. Prepare post-closing trial balance.

8. Prepare an income statement for the month of October 2016 and a balance sheet as at 31 October 2016.

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson