Refer to the information in E519, but now assume that the balance of the Allowance for Uncollectible

Question:

Refer to the information in E5–19, but now assume that the balance of the Allowance for Uncollectible Accounts on December 31, 2024, is $1,100 (debit) (before adjustment).

Data from in E5-19

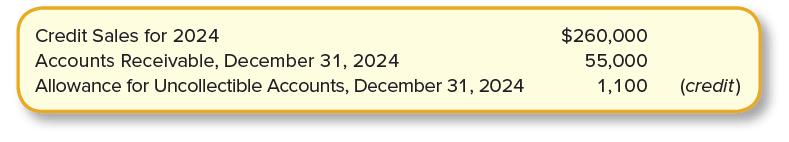

Suzuki Supply reports the following amounts at the end of 2024 (before adjustment).

Required:

1. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates 12% of receivables will not be collected.

2. Record the adjusting entry for uncollectible accounts using the percentage-of-credit-sales method. Suzuki estimates 3% of credit sales will not be collected.

3. Calculate the effect on net income (before taxes) and total assets in 2024 for each method.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: