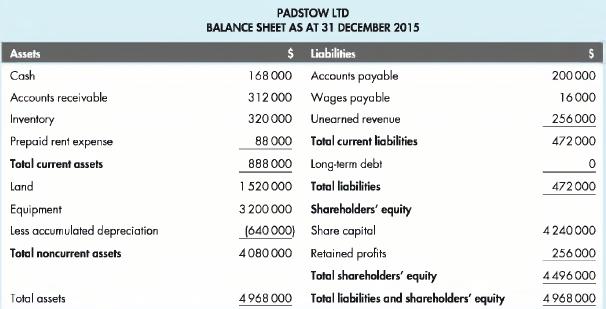

The following transactions occurred during the year ended 31 December 2016 for Padstow Ltd: a. Issued share

Question:

The following transactions occurred during the year ended 31 December 2016 for Padstow Ltd:

a. Issued share capital for $300 000 cash.

b. Expiration of prepaid rent expense (i.e. prepaid rent expense balance to zero).

c. Purchased $70 000 of inventory on credit.

d. Paid $56 000 to accounts payable.

e. Sold inventory costing $120 000 for $340 000. All sales are on credit.

f. Collected $106 000 from accounts receivable.

g. Depreciated equipment for the year using the straight-line method (10 percent per annum).

h. Dividends paid totalled $50 000.

i. Borrowed $150 000 on 1 January 2016. The loan is due on 30 June 2018 and carries a 10 percent per annum interest rate. Paid $13 000 interest on this loan during the year ended 31 December 2016.

j. On 1 April paid $30 000 for an insurance policy covering 1 April 2016 to 31 March 2017.

k. Paid wages of $160 000; wages of $30 000 had been earned but not paid to the first pay period in 2017.

I. Is owed $9500 in interest from the bank at year-end.

m. At 31 December 2016 the unearned revenue account balance had reduced to $5000.

Required:

1. List all revenues (including dollar amounts) that will appear in the income statement for the year ended 31 December 2016.

2. List all expenses (including dollar amounts, ignoring taxation) that will appear in the income statement for the year ended 31 December 2016.

3. List all current liabilities at 31 December 2016 (including dollar amounts).

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson