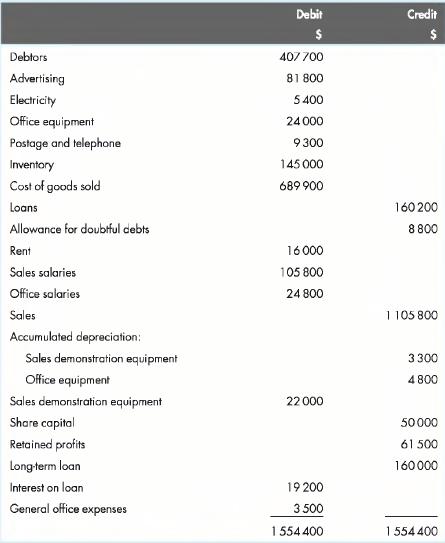

The trial balance shown below has been extracted from the general ledger of R. James Electronics Ltd

Question:

The trial balance shown below has been extracted from the general ledger of R. James Electronics Ltd at 30 June 2016. The following facts came to light after the trial balance was completed:

a. Investigation of a credit balance in a debtor's account in the subsidiary ledger showed that a credit sale of goods in May for $800 had not been recorded.

b. The last day of the period, 30 June 2016, was a Wednesday. The staff are paid on Friday for a five-day working week that ends on Friday. Sales salaries are $2035 per week and office salaries are $475 per week.

c. Electricity expenses of $350 have been incurred, but not billed and not recognised. Telephone expenses of $200 have been incurred (in respect of calls) during June, but not recognised.

d. Rent expense includes an amount of $600 prepaid for the first two weeks of July 2016.

e. Depreciation of $2400 is to be charged on office equipment and depreciation of $2805 is to be charged on demonstration equipment.

f. Interest on a loan is at the rate of 12 percent per annum, payable quarterly in advance on the last day of each quarter. The loan was made on 1 October 2015.

g. Bad debts of $700 are to be written off, and the allowance for doubtful debts is to be 2 percent of debtors.

1. Prepare general journal entries for any period-end adjustments for the above items.

2. Prepare an income statement for the year ended 30 June 2016.

3. Prepare a balance sheet as at 30 June 2016, suitably classified.

Step by Step Answer:

Financial Accounting An Integrated Approach

ISBN: 9780170349680

6th Edition

Authors: Ken Trotman, Michael Gibbins, Elizabeth Carson