(a) Land and buildings were revalued on 1 July 2011 and 26,000 of the revaluation gain was...

Question:

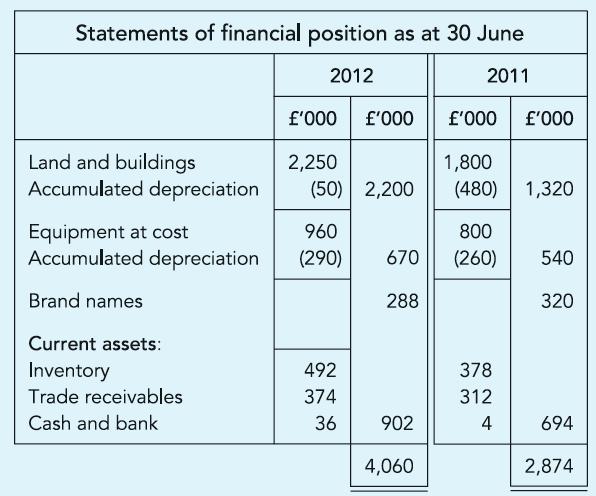

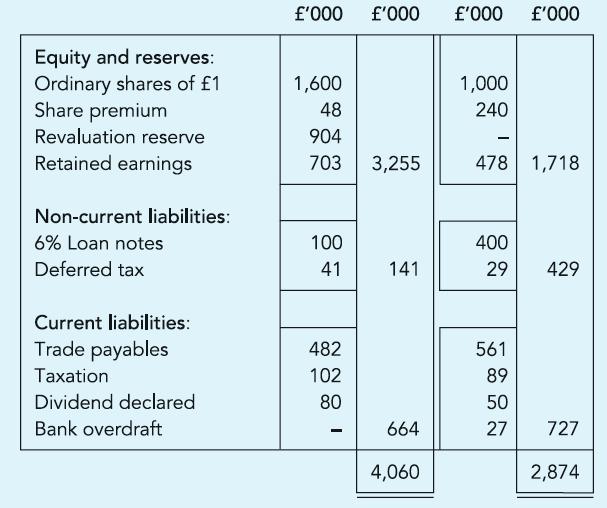

(a) Land and buildings were revalued on 1 July 2011 and £26,000 of the revaluation gain was treated as realised in the year. No new land and buildings were acquired in the year.

(b) Equipment acquired for £70,000 was sold in the year for £12,000.

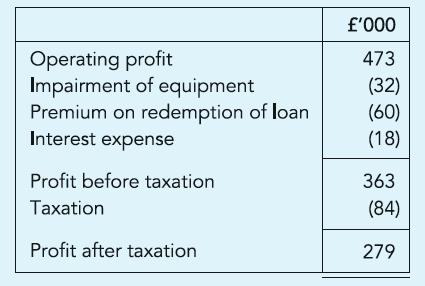

(c) Extracts from the Statement of income for the year are shown.

(d) Included within cost of sales in the year were the following:

£40,000 depreciation of equipment £32,000 amortisation of brand names and depreciation of buildings.

(e) On 1 July 2010 a bonus issue of one for five was made. The cost of the bonus issue, together with £2,000 expenses of a cash issue which took place in April 2011, has been offset from the balance in the Share premium.

Required: Prepare the Statement of cash flows for the year ended 30 June 2012.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict