A trader registered for VAT reports his purchases, sales and expenses for the year as 138,180, 174,135

Question:

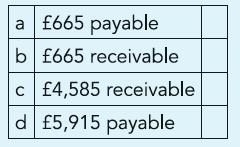

A trader registered for VAT reports his purchases, sales and expenses for the year as £138,180, £174,135 and £25,380. Additionally he paid £35,250 for an office vehicle and £15,040 for office equipment. The amounts stated are all inclusive of VAT at 17.5%. The Statement of financial position as at the year-end will report VAT as:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted: