A trader registered for VAT reports his purchases, sales and expenses for the year as 92,120, 116,090

Question:

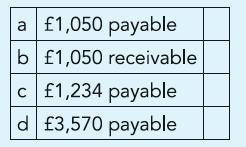

A trader registered for VAT reports his purchases, sales and expenses for the year as £92,120, £116,090 and £16,920 respectively. The amounts reported are all inclusive of VAT at 17.5%. The Statement of Financial position as at the year-end will report VAT as:

Transcribed Image Text:

a £1,050 payable b £1,050 receivable c £1,234 payable d £3,570 payable

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

a ...View the full answer

Answered By

Sheikh Muhammad Ibrahim

During the course of my study, I have worked as a private tutor. I have taught Maths and Physics to O'Level and A'Level students, as well as I have also taught basic engineering courses to my juniors in the university. Engineering intrigues me alot because it a world full of ideas. I have passionately taught students and this made me learn alot. Teaching algebra and basic calculus, from the very basics of it made me very patient. Therefore, I know many tricks to make your work easier for you. I believe that every student has a potential to work himself. I am just here to polish your skills. I am a bright student in my university. My juniors are always happy from me because I help in their assignments and they are never late.

4.90+

14+ Reviews

24+ Question Solved

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted:

Students also viewed these Business questions

-

A trader registered for VAT reports his purchases, sales and expenses for the year as 138,180, 174,135 and 25,380. Additionally he paid 35,250 for an office vehicle and 15,040 for office equipment....

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Bonsai (Pty) Ltd is involved in the supply of plants, koi fish, feeding products, and other accessories for marine life. The company had the following income and expenses for the year of assessment:...

-

For OEM & Aftermarket Parts Distribution Companies (reference an example company) Describe the sales presentation method: Salesperson to buyer? Salesperson to buyer to group? Sales team to buyer...

-

Explain how a partners basis in a partnership can differ from the partners at-risk amount.

-

How does pollution distort resource allocation in the economy? Consider both over- and under-allocation of resources.

-

If people pay for good weather, who ultimately receives the good-weather payment?

-

Jocame Inc. began business on January 2, 2013. Salaries were paid to employees on the last day of each month, and social security tax, Medicare tax, and federal income tax were withheld in the...

-

6.Max Co is a large multinational company which expects to have a $10m cash deficit in one month's time. The deficit is expected to last no more than two months. Max Co wishes to resolve its...

-

A telephone bill for 3,290 (inclusive of VAT) remaining unpaid should be accounted for as: (a) Debit Telephone expense 2,800, debit VAT account 490, credit Bank account 3,290 (b) Debit Telephone...

-

Goods costing 6,815 (inclusive of VAT) removed by a sole trader for personal use should be accounted for as: (a) Debit Drawings account and credit Purchases account 6,815 (b) Debit Drawings account...

-

Following are measurements of soil concentrations (in mg/kg) of chromium (Cr) and nickel (Ni) at 20 sites in the area of Cleveland, Ohio. These data are taken from the article Variation in North...

-

Find the regression line for the data points in Problems 31-38. 10 20 30 30 50 60 y 20 48 60 58 70 75

-

For the acquirer, what is the difference in income tax treatment of goodwill acquired in a direct purchase of assets as compared to goodwill acquired in a purchase of shares?

-

In Problems 25-40, decide on a reasonable means for conducting the survey to obtain the desired information. The city council wants to use a survey to determine the extent of public approval for a...

-

What is the cumulative distribution?

-

Suppose that the breaking strength of a rope (in pounds) is normally distributed, with a mean of 100 pounds and a standard deviation of 16 . What is the probability that a certain rope will break...

-

Baker Company acquires an 80% interest in the common stock of Cain Company for $440,000 on January 1, 2011. The price is equal to the book value of the interest acquired. Baker Company maintains its...

-

Reichenbach Co., organized in 2018, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2018 and 2019. Instructions...

-

Caroline, age 66 and filing single as a dependent of another, received the following income items for the current year: Social Security benefits (nontaxable) ..$ 3,000 Pension benefits (taxable)...

-

Randall and Dianne Wall live in St. Louis, Missouri. Randall and Dianne are each 30 years old, neither smokes, and they have no children or other dependents. Randall is attending law school full time...

-

Carolyn is unmarried and has one dependent child, age 6, who lived with her for the entire year. In 2017, she has income of $16,000 in wages and $6,000 in alimony. Her AGI is $22,000. a. What is...

-

In testing controls over cash disbursements, an auditor most likely would determine that the person who signs the check also: A . Is denied access to the supporting documents. B . Approves the...

-

Which is the correct answer? What advantage do sole proprietorships have over corporations? Question 14 options: Owners of sole proprietorships cannot be held responsible for their company's debts....

-

When making predictions about cash flows relevant to investment decisions, managerial accountants rely on Blank______. Multiple select question. knowledge of market conditions historical accounting...

Study smarter with the SolutionInn App