A vehicle acquired for 60,000 on 1 September 2005 and depreciated at 20% of cost per annum

Question:

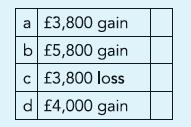

A vehicle acquired for £60,000 on 1 September 2005 and depreciated at 20% of cost per annum (time apportioned) was sold for £4,000 on 31 March 2011. Expenses of disposal was £200. What is the gain or loss on disposal?

Transcribed Image Text:

a £3,800 gain b £5,800 gain c£3,800 loss d £4,000 gain

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

a ...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted:

Students also viewed these Business questions

-

A business has a policy of capitalizing expenditure over 500. You are working on the accounting records of a business for the year ended 31 March 2019. A machine was acquired on 1 April 2016. The...

-

As at 31 December 2010 a manufacturer reported at 424,000 machinery which had originally cost 840,000. A machine was acquired for 80,000 on 1 April 2011 and on 1 July 2011 a machine acquired for...

-

The agreed contract price is $96,000. How should this price be allocated to performance obligations? Llama limited sells and equipment on January 01, 2019 which she bought on January 01,2016 for...

-

Cancer is a frightening disease. The biological process that creates cancerous cells from healthy tissue is poorly understood at best. Much research has been conducted into how external conditions...

-

A piece of machinery purchased at a cost of $50,000 has an estimated salvage value of 20% of the first cost and service life of 5 years and is depreciated using MACRS. a) Prepare the MACRS annual...

-

On September 14, 2014, Jay purchased a passenger automobile that is used 75 percent in his accounting business. The automobile has a basis for depreciation purposes of $35,000, and Jay uses the...

-

Creusot-Loire, a French company, was the project engineer for the construction of ammonia plants in former Yugoslavia and Syria. Creusot-Loire contracted with Coppus Engineering for the purchase of...

-

During the 1984 Olympics Frank and Irma rented their home in Hollywood, California and enjoyed a three-week vacation at their condo in Malibu, California. By 2000, they decided to retire to the Palm...

-

1 Explain briefly about six sigma and capacity maturity models? 2 Explain about the contemporary management practices taking place in Indian business model? 3 4 What is performance management?...

-

Jessica Parker is a graduate in management and finance, and is reporting in a current account maintained in the ledger the amounts she may feel free to withdraw at any time from the business. She has...

-

Machinery, acquired at a cost of 660,000, is reported on the Statement of financial position on 30 June 2011 at a carrying value of 431,500. A machine had been acquired for 60,000 on 1 December 2010;...

-

To compare the demand for two different entrees, the manager of a cafeteria recorded the number of purchases of each entree on seven consecutive days. The data are shown in the table. Do the data...

-

Explain the direct and indirect costs associated with the budget. Direct Cost Direct Costs: These are costs directly associated with the project. They include Training Material, Salary/Wages, and...

-

In this Java code, which of these class members are inherited and accessible in the subclass? public class Super { public int x; protected String; private double y; public abstract void doStuff();...

-

How are binary search trees useful in programming? Give three examples of applications/problems that can be helped by using BSTs. b. Question 2: How are heaps useful in programming? Give three...

-

Differences arising between the actual and expected values of the pension contributions What are actuarial losses or gains in a defined benefit plan?

-

What would be a good closing paragraph to end the paper concerning Targets net liabilities and net tangible assets?

-

The following data represent the ages of the presidents of the United States (from George Washington through Barack Obama) on their ï¬rst days in ofï¬ce. (a) Construct a...

-

Show that, given a maximum flow in a network with m edges, a minimum cut of N can be computed in O(m) time.

-

Distinguish between simple and compound interest.

-

Distinguish between the discounted present value of a stream of future payments and their net present value . If there is no distinction, then so state?

-

Does the present value of a given amount to be paid in 10 years increase or decrease if the interest rate increases? Suppose that the amount is due in 5 years? 20 years? Does the present value of an...

-

Assume that Concrete Creations uses the weighted-average method for cost allocation. Determine equivalent units of production for the Forming Department for the month of May. Percent Completed Units...

-

What are the nuanced strategies for fostering empowerment amidst multifaceted organizational structures?

-

A business operated at 100% of capacity during its first month and incurred the following costs: Production costs (17,000 units): Direct materials $183,500 Direct labor 229,000 Variable factory...

Study smarter with the SolutionInn App