As at 31 December 2010 a manufacturer reported at 424,000 machinery which had originally cost 840,000. A

Question:

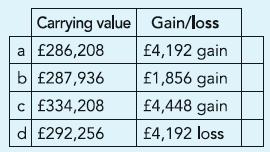

As at 31 December 2010 a manufacturer reported at £424,000 machinery which had originally cost £840,000. A machine was acquired for £80,000 on 1 April 2011 and on 1 July 2011 a machine acquired for £120,000 on 1 April 2008 was sold for £20,000. Machinery is depreciated at 40% per annum on the reducing balance method with time apportionment. What is the carrying value (cost less accumulated depreciation) as at 31 December 2011 and the gain or loss on the disposal of machinery?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted: