Grace Bert commenced business on 1 January 2010 with a capital in cash of 10,000. Her transactions

Question:

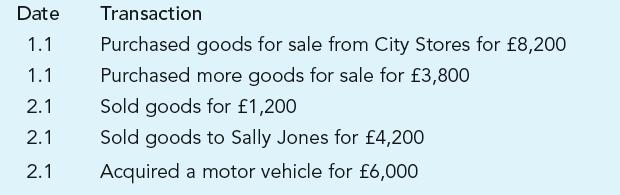

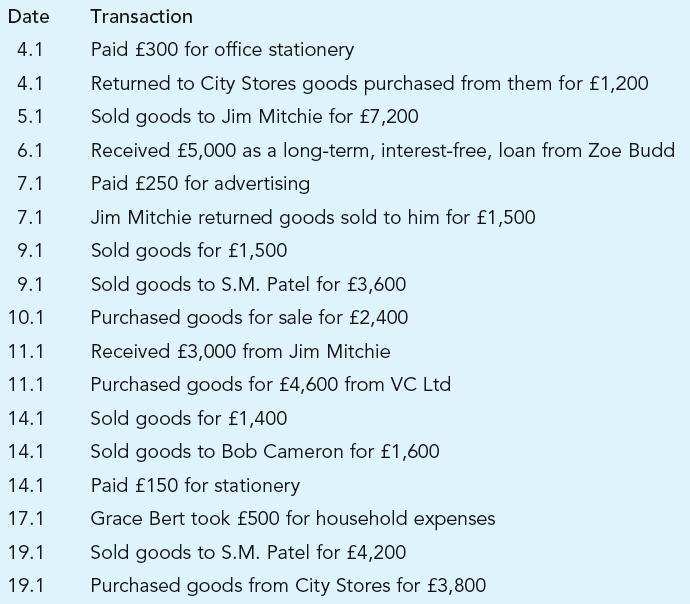

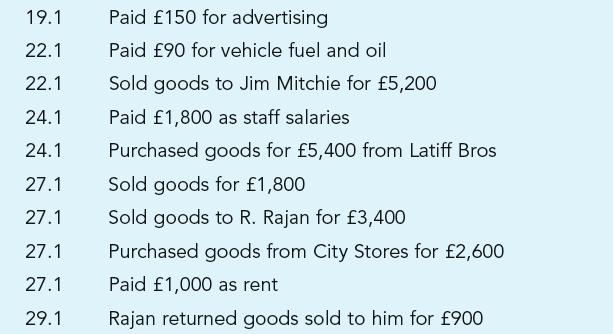

Grace Bert commenced business on 1 January 2010 with a capital in cash of £10,000. Her transactions in the first month were as follows:

If a transaction identifies the other party assume it to be on credit terms. There are no unsold goods in hand at the month-end and ignore depreciation.

Required:

(a) Record the transactions in appropriate books of prime entry.

(b) Post them to the Nominal ledger, Receivables ledger and Payables ledger, as appropriate.

(c) Extract a Trial Balance from the books of Grace Bert as at 31.1.2010.

(d) Prepare the Statement of income for the month ended 31.1.2010 and a Statement of financial position as at that date.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted: