Jerry, owner of a retail shop, does not maintain proper accounting records. He seeks your assistance to

Question:

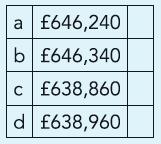

Jerry, owner of a retail shop, does not maintain proper accounting records. He seeks your assistance to calculate his sales revenue in the year. He habitually banks his daily takings intact, leaving a float of £100 to meet incidental expenses and after taking £20 per day for household expenses. Incidental expenses paid in cash, recorded in his diary, amounted to £26,640. He makes other payments always by cheque and the total cheque payments in the year amounted to £595,400. His bank balance at the beginning of the year was £29,400 and at the end £41,800. His trade receivables were £18,400 at commencement of the year and £22,900 at the end. What was his sales revenue in the year?

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict