Jill Grey operates the Town Shop on premises leased for ten years from 1.1.2009 paying 200,000 for

Question:

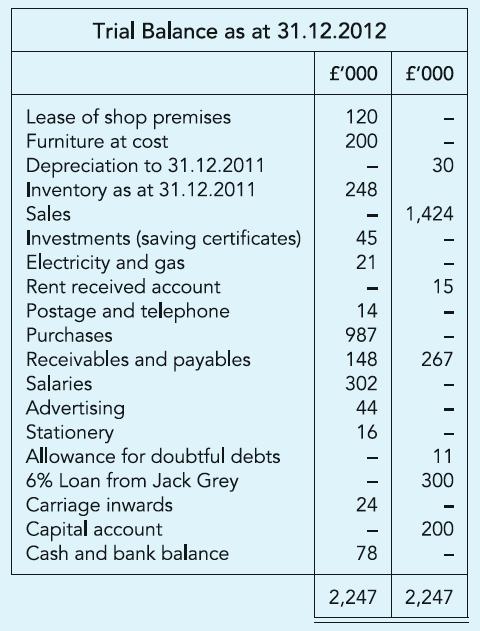

Jill Grey operates the Town Shop on premises leased for ten years from 1.1.2009 paying £200,000 for the period. The upper floors of the premises contain two flats. Jill occupies one and has let out the other at £250 per week. She has also invested cash surplus to immediate requirements of the shop in savings certificates. The year-end Trial Balance of the shop appears as shown. You are informed as follows:

(a) Inventory taken on 7 January 2013 reveals the cost of unsold goods in hand as £312,000 and unused stationery as £3,000. During the seven days after 31 December purchases amounted to £11,000, Sales (at cost plus 40%) amounted to £28,000, and stationery has been acquired for £1,000.

(b) A debt of £8,000 is to be written off and the allowance for doubtful debts adjusted to cover 10% of the amount outstanding.

(c) Salary and electricity of £18,000 and £3,000 respectively remain unpaid as at 31 December 2012.

(d) Jill estimates that a tenth of the cost of the lease may be allocated to each flat and depreciates furniture at 10% per annum, using the reducing balance method.

(e) One third of the cost of electricity and gas is to be recovered from Jill.

(f) Interest of £4,000 earned on savings certificates is yet to be accounted for.

Required:

The Statement of income for the year ended 31 December 2012 and the Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict