Mackie Stores proceeded to finalise its accounts for the year ended 31.12.2012, by placing the difference in

Question:

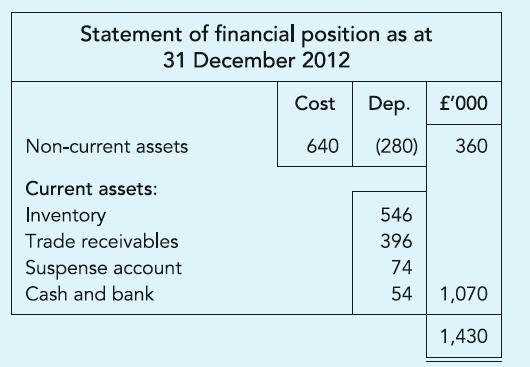

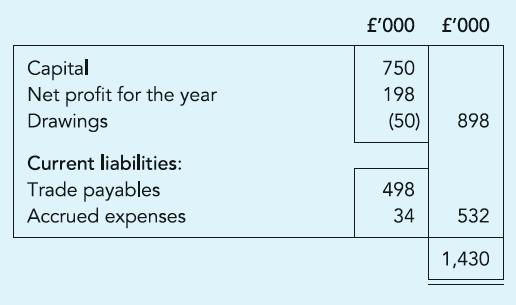

Mackie Stores proceeded to finalise its accounts for the year ended 31.12.2012, by placing the difference in the Trial Balance in a Suspense account and reporting the Suspense account balance as a current asset on its Statement of financial position, as shown. Early in 2013 attempts were made to clear the Suspense account, detecting the following errors:

(a) £17,000, being the cost of goods returned to suppliers, was posted to the credit of the supplier’s account.

(b) £24,000 paid for advertising has been posted as £42,000.

(c) £58,000 paid to suppliers was not posted.

(d) £48,000 paid for carriage inwards was posted to the Carriage outwards account.

(e) £14,000, being the cost of goods removed for personal use by the proprietor, has not been accounted for.

Mackie Stores has reported a gross profit of £758,000 for the year ended 31 December 2012.

Required:

(a) Set out the journal entries to rectify the errors detected in 2013, bearing in mind that the Statement of income has already been prepared.

(b) Ascertain the corrected gross profit and net profit for the year ended 31 December 2012.

(c) Set out the amended Statement of financial position as at 31 December 2012.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict