Mike Russell commenced business on 1 January 2010 with a capital in cash of 100,000. On the

Question:

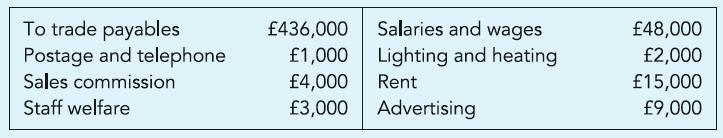

Mike Russell commenced business on 1 January 2010 with a capital in cash of £100,000. On the same date he acquired some furniture for £10,000 and a vehicle for £20,000. Sales during the year on credit terms amount to £492,000 and he received £458,000 from his credit customers. His payments during the year to 31 December 2010 are summarised as follows:

Trade payables as at 31 December 2010 amount to £29,000.

Required:

(a) Account for the above transactions, extracting a Trial Balance as at 31.12.2010.

(b) Account for the closing inventory of £78,000, find the cost of goods sold and extract a second Trial Balance immediately thereafter.

(c) Account for the following year-end adjustments, extracting another Trial Balance after making the adjustments: Mike expects to use his furniture and vehicle for five years and wishes to depreciate both using the straight-line method. He reports that as at 31 December 2010 he owes £4,000 as salaries and £1,000 for heating; while the rent for the shop premises has been agreed at £1,000 per month.

(d) Prepare a Statement of income for the year ended 31.12.2010 and a Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict