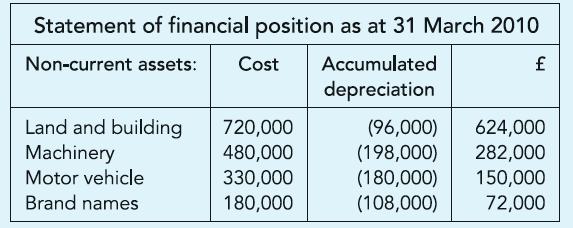

Non-current assets were reported on the Statement of financial position as at 31 March 2010 as shown.

Question:

Non-current assets were reported on the Statement of financial position as at 31 March 2010 as shown. You are informed as follows:

(a) As at 1 April 2010 land was valued at £400,000 and buildings at £800,000. Land and buildings are to be reported in accounts at current values. Buildings have been depreciated at 2% per annum assuming that one-third of the cost was for land which is not depreciated.

(b) Machinery has been depreciated at 10% per annum using the straight-line method. Due to changes in consumer preference, the machinery is expected to become obsolete by 31 March 2013. Sale of products from the machinery in the year to 31 March 2011 was £128,000 and the present value as at 1 April 2010 of sales expected in years ending 31 March 2012 and 2013, until obsolescence, is determined as £112,000.

(c) Motor vehicles are depreciated at 25% per annum on the reducing balance method. A vehicle, acquired for £160,000 on 1 April 2008, was sold for £58,000 on 30 November 2010 and replaced next day with another at a cost of £240,000.

(d) Brand names, acquired on 1 April 2008, are being depreciated on the sum of the years’ digits method assuming a useful life of five years.

Required:

Prepare a statement of movement of non-current assets for the year ended 31 March 2011.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict