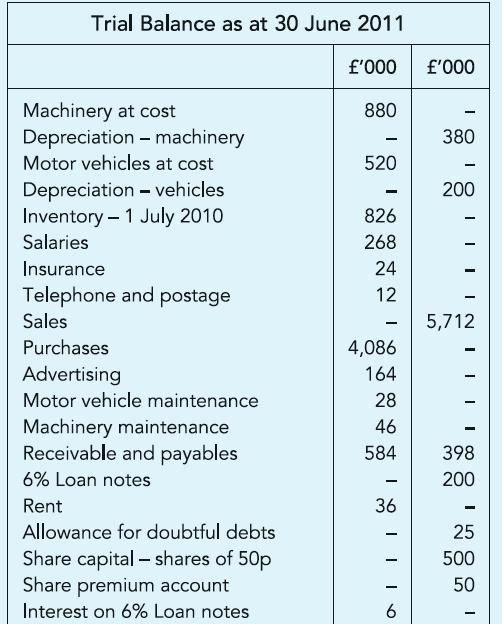

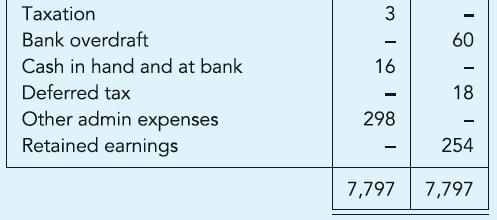

Norwich Tanners and Curriers (NTC) extracted its yearend Trial Balance as shown. You are informed as follows:

Question:

Norwich Tanners and Curriers (NTC) extracted its yearend Trial Balance as shown.

You are informed as follows:

(i) Inventory is ascertained on 5 July 2011 at £752,000. During the five days after 30 June purchases were £154,000 and sales (made at cost plus a third) were £180,000. The inventory results include at £9,000 the cost of spares bought for repairing machinery.

(ii) Machinery and vehicles are depreciated at 5% and 20% per annum respectively using the reducing balance method.

(iii) Insurance includes £16,000 paid for the year ending on 30 September 2011.

(iv) 6% Loan notes, issued on 1 October 2010, are redeemable at par on 30 September 2014.

(v) Salary £32,000, advertising £18,000 and rent £12,000 remain unpaid by the year-end.

(vi) £4,000 of trade receivable should be written off and the allowance adjusted to 5% of receivable.

(vii) Amount reported as taxation is the amount by which tax paid on profit of the previous year exceeded the amount provided for. Current year tax, at 20%, is estimated at £44,000. On 30 June 2011, the tax base was £75,000 lower than the corresponding written-down value of assets.

(viii) On 30 June 2011 the Directors of NTC declared a dividend of 3p per share.

Required:

(a) Prepare a Statement of income with the Statement of changes in equity for the year ended 30 June 2011 and the Statement of financial position as at that date.

(b) With regard to the adjustments that had to be made in respect of information provided as (i) to (vii), explain the need for these adjustments on the basis of generally accepted accounting concepts.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict