Sarah and Betty were in partnership sharing profits and losses in the ratio they contributed their capital,

Question:

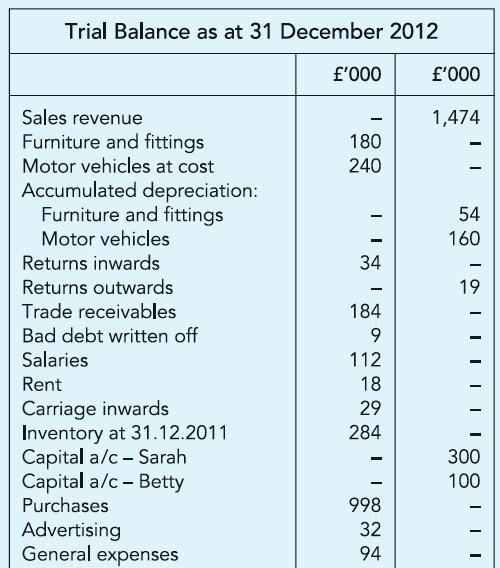

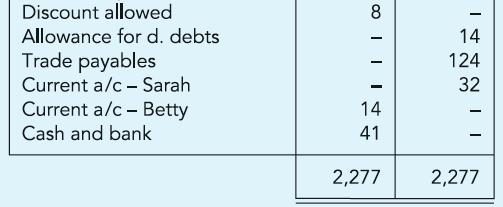

Sarah and Betty were in partnership sharing profits and losses in the ratio they contributed their capital, after allowing interest at 6% per annum on their fixed Capital account balances and allowing Betty a salary of £2,000 per month. The premises used by the business belong to Sarah who has been promised a rent of £2,000 per month. The Trial Balance extracted at the year-end is set out. You are informed as follows:

(i) Salaries account includes £22,000 drawn by Betty.

(ii) Goods costing £8,000 removed by Sarah for personal use have not been accounted for.

(iii) As at the year-end advertising £9,000 and general expenses £12,000 remain unpaid.

(iv) Trade receivables of £4,000 should be written off and the allowance for doubtful debts adjusted to cover 5% of remaining trade receivables.

(v) Depreciation should be written off on furniture and motor vehicles at 10% and 20% per annum respectively, using the reducing balance method.

(vi) Cost of year-end inventory has been ascertained to be £364,000. This includes at £24,000 the cost of some shop-soiled items which are expected to be sold for £17,000 after reconditioning them at a cost of £2,000.

Required:

The Statement of income for the year ended 31 December 2012 and the Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict