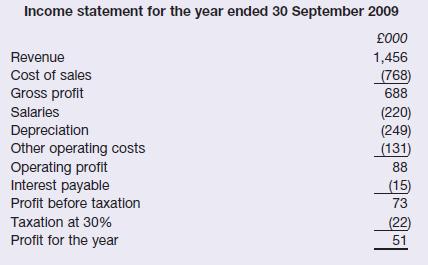

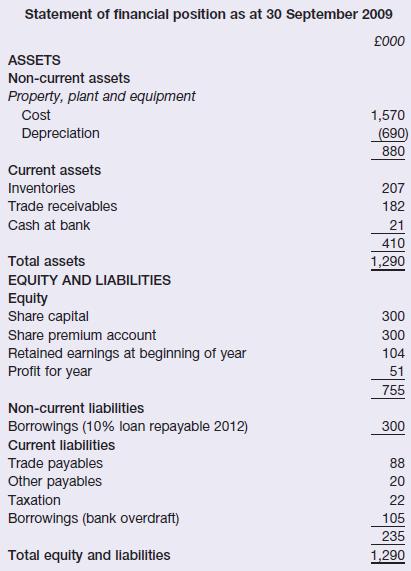

Presented below is a draft set of simplified financial statements for Pear Limited for the year ended

Question:

Presented below is a draft set of simplified financial statements for Pear Limited for the year ended 30 September 2009.

The following information is available:

1 Depreciation has not been charged on office equipment with a carrying amount of £100,000.

This class of assets is depreciated at 12 per cent a year using the reducing-balance method.

2 A new machine was purchased, on credit, for £30,000 and delivered on 29 September 2009 but has not been included in the financial statements. (Ignore depreciation.)

3 A sales invoice to the value of £18,000 for September 2009 has been omitted from the financial statements. (The cost of sales figure is stated correctly.)

4 A dividend of £25,000 had been approved by the shareholders before 30 September 2009, but was unpaid at that date. This is not reflected in the financial statements.

5 The interest payable on the loan for the second half-year was not paid until 1 October 2009 and has not been included in the financial statements.

6 An allowance for receivables is to be made at the level of 2 per cent of receivables.

7 An invoice for electricity to the value of £2,000 for the quarter ended 30 September 2009 arrived on 4 October and has not been included in the financial statements.

8 The charge for taxation will have to be amended to take account of the above information.

Make the simplifying assumption that tax is payable shortly after the end of the year, at the rate of 30 per cent of the profit before tax.

Required:

Prepare a revised set of financial statements for the year ended 30 September 2009 incorporating the additional information in 1 to 8 above. (Work to the nearest £1,000.)

Step by Step Answer:

Accounting An Introduction

ISBN: 9780273733201

5th Edition

Authors: Eddie McLaney, Dr Peter Atrill, Eddie J. Mclan