Question: Requirement 1. Journalize the partners' initial contributions. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table.)

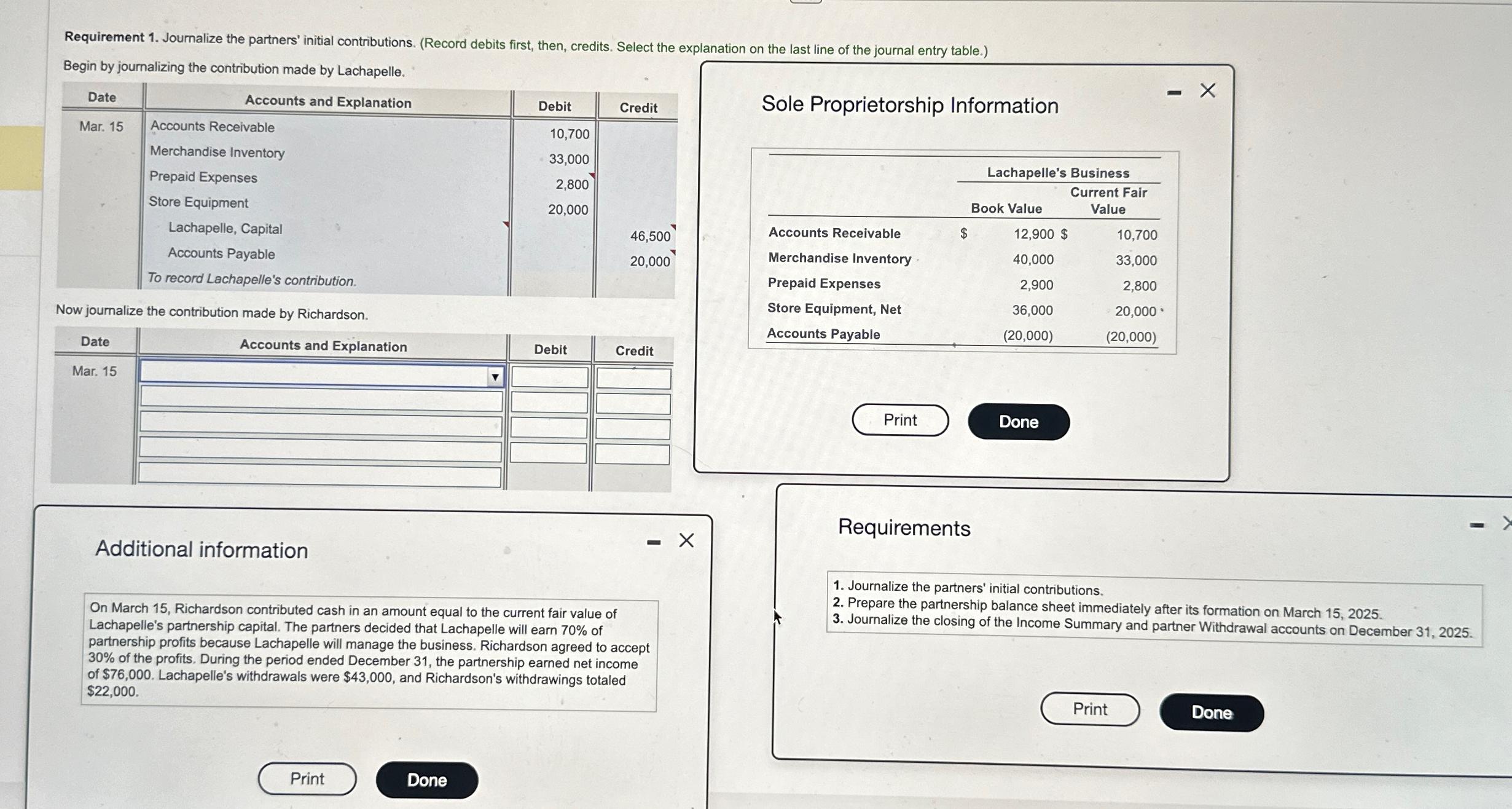

Requirement 1. Journalize the partners' initial contributions. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing the contribution made by Lachapelle. Accounts and Explanation Sole Proprietorship Information Date Mar. 15 Date Accounts Receivable Merchandise Inventory Lachapelle, Capital Accounts Payable To record Lachapelle's contribution. Now journalize the contribution made by Richardson. Mar. 15 Prepaid Expenses Store Equipment Accounts and Explanation Additional information Print Debit Done 10,700 33,000 2,800 20,000 Debit Credit 46,500 20,000 Credit On March 15, Richardson contributed cash in an amount equal to the current fair value of Lachapelle's partnership capital. The partners decided that Lachapelle will earn 70% of partnership profits because Lachapelle will manage the business. Richardson agreed to accept 30% of the profits. During the period ended December 31, the partnership earned net income of $76,000. Lachapelle's withdrawals were $43,000, and Richardson's withdrawings totaled $22,000. - X - Accounts Receivable Merchandise Inventory Prepaid Expenses Store Equipment, Net Accounts Payable Print $ Lachapelle's Business Book Value Requirements 12,900 $ 40,000 2,900 36,000 (20,000) Done Current Fair Value 10,700 33,000 2,800 20,000. (20,000) Print - X 1. Journalize the partners' initial contributions. 2. Prepare the partnership balance sheet immediately after its formation on March 15, 2025. 3. Journalize the closing of the Income Summary and partner Withdrawal accounts on December 31, 2025. Done

Step by Step Solution

There are 3 Steps involved in it

To joumalize the partners initial contributions we will start by recording the contribution made ... View full answer

Get step-by-step solutions from verified subject matter experts