Rupert owns a retail shop but does not maintain any accounting records. The Tax Inspector prepared a

Question:

Rupert owns a retail shop but does not maintain any accounting records. The Tax Inspector prepared a Statement of affairs for him on 30 June 2011 establishing his capital on that date as £426,500. Making a similar exercise one year later, his capital in the business was established at £596,800. Further inquiries reveal that:

(a) He has no other source of income;

(b) He must be spending not less than £2,000 per month on living;

(c) He educates his son at Harvard spending on average £1,000 per month;

(d) He paid £40,000 in the year for a personal car, selling the old one for £8,000.

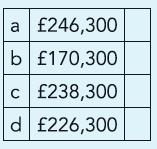

What is your estimate of his business profit in the year?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict

Question Posted: