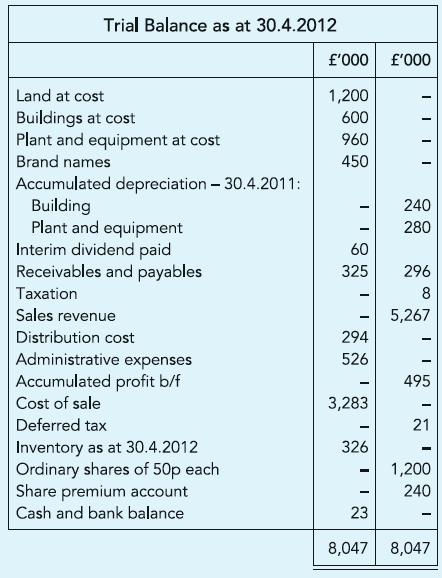

Sinclair plcs year-end Trial Balance is stated. The following information is provided: (i) Directors have resolved to

Question:

Sinclair plc’s year-end Trial Balance is stated. The following information is provided:

(i) Directors have resolved to report land and buildings at current values and have ascertained the market values on 1 May 2011 of land and buildings as £3,000,000 and £900,000 respectively. From the date of revaluation buildings have an expected useful life of 30 years.

(ii) Plant and equipment are depreciated at 10% per annum on the reducing balance method; while brand names, acquired on 1 May 2008, are depreciated over a five-year period using the sum of the years’ digits method. All depreciation is to be included within cost of sales.

(iii) Amount reported as taxation is the amount by which the amount set aside for the purpose exceeded the amount at which previous year’s tax was settled. Current year’s tax, at 20%, is estimated at £94,000; while the tax base is lower than the written-down value of corresponding assets by £180,000.

(iv) A cash issue of 100,000 ordinary shares was made at 75p each in May 2011 and on 30 April 2012 directors have declared a second interim dividend of 5p per share.

Required:

For publication,

(a) The Statement of comprehensive income for the year ending 30 April 2012.

(b) The Statement of changes in equity tracing all movements with shareholders, and

(c) the Statement of financial position as at 30 April 2012.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict