Sylvio plc has extracted its year-end Trial Balance as shown below, after after making most of the

Question:

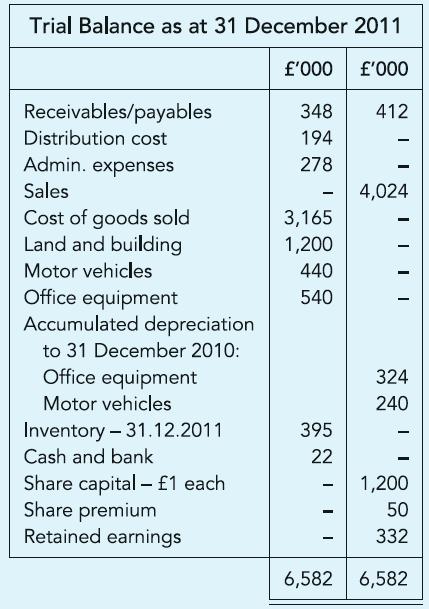

Sylvio plc has extracted its year-end Trial Balance as shown below, after after making most of the year-end adjustments. You are informed as follows:

(a) Buildings, not depreciated until now, need to be depreciated as follows: For 8 years until 31 December 2010: £144,000. For year ended 31 December 2011: £18,000. As at 31 December 2011 the market value of land and buildings has been identified as £1.5 million. Directors wish to report this asset at market value.

(b) The motor vehicles are depreciated at 25% p.a. on the reducing balance method. Office equipment, used for administration, is depreciated at 10% per annum on cost. However, on 1 January 2011 the directors decided that to keep up with changes in technology equipment needed to be replaced by 31 December 2013.

(c) Corporation tax on the year’s profit is estimated at £55,000.

(d) Directors have declared a dividend of 4p per share.

Required:

(a) Prepare the Statement of comprehensive income for the year ended 31 December 2011

(b) with the Statement of changes in equity and

(c) the Statement of financial position as at that date.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict