The Trial Balance as at 31 December 2011 reports the Machinery account balance as 360,000 and the

Question:

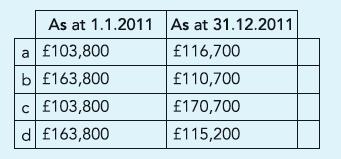

The Trial Balance as at 31 December 2011 reports the Machinery account balance as £360,000 and the balance in Accumulated depreciation (up to 31 December 2010) as £184,200. The balance in the Machine account includes a machine acquired for £72,000 on 1 May 2011. A machine acquired for £60,000 on 1 April 2006 had been sold for £24,000 on 30 September 2011. None of the entries necessary to account for the machine disposal have been made other than crediting the Sales account with the amount received from disposal. Machinery is depreciated using the straight-line method and assuming a useful life of ten years. What is the carrying value (i.e. cost less accumulated depreciation to date) of machinery as at 1 January 2011 and as at 31 December 2011?

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict