The Trial Balance as at 31 December 2011 reports the Machinery account balance as 480,000 and the

Question:

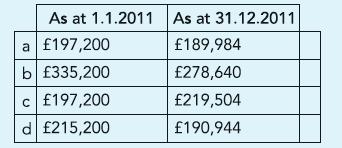

The Trial Balance as at 31 December 2011 reports the Machinery account balance as £480,000 and the balance in Accumulated depreciation (up to 31 December 2010) as £144,800. The balance in the Machine account includes a machine acquired for £120,000 on 1 April 2011. A machine acquired for £84,000 on 1 May 2009 had been sold for £18,000 on 31 October 2011. None of the entries necessary to account for the machine disposal have been made. Machinery is depreciated at 40% per annum, using the diminishing balance method. What is the carrying value of the machinery (i.e. cost less accumulated depreciation) as at 1 January 2011 and as at 31 December 2011? No depreciation required in year of disposal.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict