When Alpha paid 1,200 to acquire 640 ordinary shares in Beta on 1 January 2010: (i) There

Question:

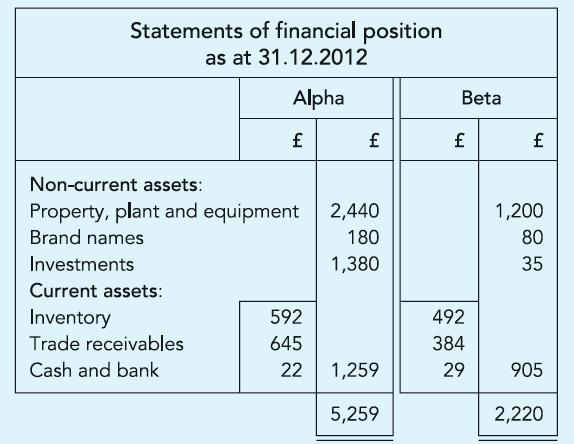

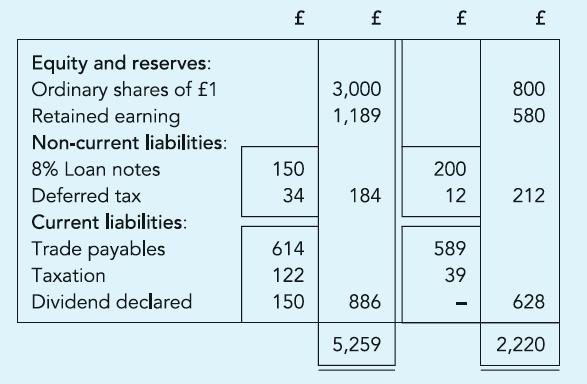

When Alpha paid £1,200 to acquire 640 ordinary shares in Beta on 1 January 2010:

(i) There was a gain of £300 and £40 on the fair valuation of Beta’s property, plant and equipment and brand names respectively.

(ii) Beta’s retained earnings were £120; and

(iii) Beta’s shares were quoted at 160p each.

You are informed as follows:

(a) Trade receivables reported by Alpha includes £145 due from Beta. The amount reported by Beta is different because of the following:

■ Goods in transit at £32

■ Cash in transit of £15.

(b) Inventory held by Beta on 31 December 2012 includes goods invoiced by Alpha at £96. Alpha invoices Beta at cost plus a third.

(c) Based on fair valuation Beta should have written off an additional depreciation of £15 per annum on property, plant and equipment and additional amortisation of £5 per annum on brand names.

(d) A dividend of 5p per share, declared by the directors of Beta on 31 December 2012, has not been accounted for by either company.

(e) There was no impairment of goodwill.

Required:

Prepare the Consolidated Statement of financial position.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict