Alpha paid 450 to acquire 300 ordinary shares in Beta on 1 July 2010 when: (i) Betas

Question:

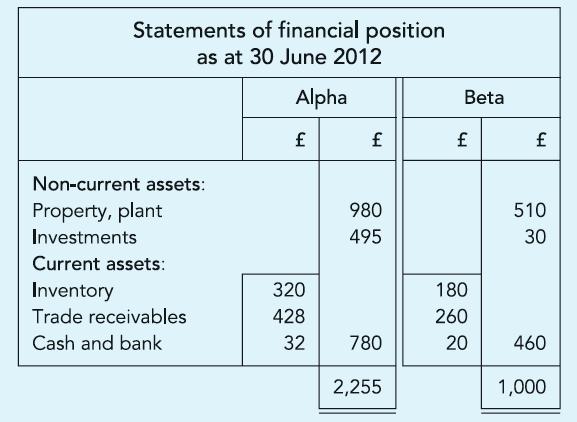

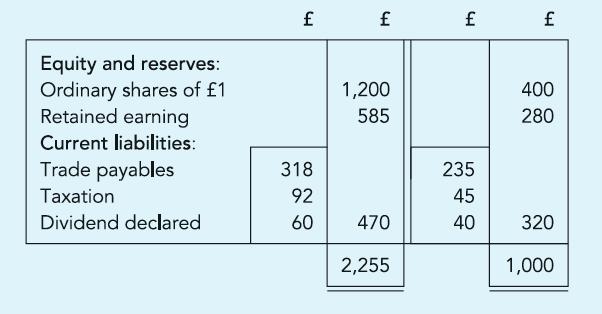

Alpha paid £450 to acquire 300 ordinary shares in Beta on 1 July 2010 when:

(i) Beta’s Retained earnings were £40;

(ii) Fair value of Beta’s property plant was £120 more than the book value; and

(iii) Beta’s shares were quoted at 130p each.

You are informed as follows:

(a) As at 30 June 2012 Receivables reported by Alpha included £80 due from Beta; whereas the corresponding amount reported by Beta was £62. Goods in transit on this date were £15. The remainder of the difference arose from cash in transit.

(b) Based on fair valuation Beta should have depreciated its property and plant by £4 more per annum.

(c) As at 30 June 2012 Beta’s inventory included goods invoiced to it by Alpha at £75. Alpha invoices Beta at prices calculated to produce a gross profit ratio of 20%.

Required:

Prepare the Consolidated Statement of financial position as at 30 June 2012.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict