Who we are Royal Mail is the UKs pre-eminent delivery company, connecting people, customers and businesses. As

Question:

Who we are Royal Mail is the UK’s pre-eminent delivery company, connecting people, customers and businesses.

As the UK’s sole designated Universal Service Provider1, we are proud to deliver a ‘one-price-goesanywhere’

service on a range of letters and parcels to more than 29 million addresses, across the UK, six-days-a-week.

Financial Review: Property On 14 October 2014, the Company announced that contracts had been exchanged for the sale of the former Paddington Mail Centre to Great Western Developments Limited for £111 million in cash.

Total net cash proceeds of the sale of £108 million were received on completion on 8 December 2014 and a profit on disposal of £106 million has been recorded as a non-operating specific item.

We continue to market the site at Nine Elms and to evaluate our options in relation to the site at Mount Pleasant. These larger sites will require further investment in order to optimise value, which will be mainly met by the proceeds from the sale of the Paddington site.

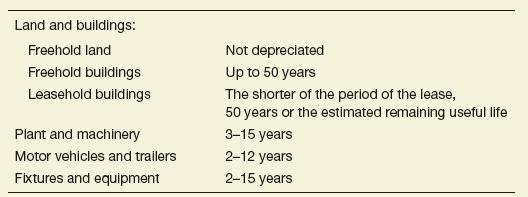

Accounting policies: Property, plant and equipment Property, plant and equipment is recognised at cost, including directly attributable costs in bringing the asset into working condition for its intended use. Depreciation of property, plant and equipment is provided on a straight-line basis by reference to net book value and to the remaining useful economic lives of assets and their estimated residual values. The useful lives and residual values are reviewed annually and adjustments, where applicable, are made on a prospective basis. The lives assigned to major categories of property, plant and equipment are:

An item of property, plant and equipment is derecognised upon disposal or when no future economic benefits are expected from its use or disposal. Any gain or loss arising at derecognition of the asset (calculated as the difference between the net disposal proceeds and the carrying amount of the asset)

is included in the income statement in the year that the asset is derecognised. Gains or losses from the disposal of assets are recognised in the income statement when all significant risks and rewards of ownership are transferred to the customer.

All subsequent expenditure on property, plant and equipment is capitalised if it meets the recognition criteria, and the carrying amount of those parts replaced is de-recognised. All other expenditure including repairs and maintenance expenditure is recognised in the income statement as incurred.

impairment reviews Unless otherwise disclosed in these accounting policies, assets and cash generating units are reviewed for impairment if events or changes in circumstances indicate that the carrying value may be impaired. The Group assesses at each reporting date whether such indications exist. Where appropriate, an impairment loss is recognised in the income statement for the amount by which the carrying value of the asset (or cash generating unit) exceeds its recoverable amount, which is the higher of an asset’s net realisable value and its value in use.

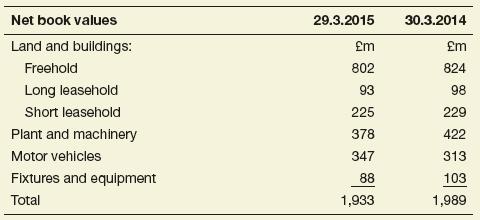

Extract from Note 21 to the balance sheet

Discussion points 1 What information is provided in the accounting policies section that is not in the financial review or the Note to the balance sheet?

2 How does the combination of information from all parts of the Annual report help the user understand the relative significance of each type of asset to the company?

Step by Step Answer: