Jet Ltd has been in business for 5 years. The ledger at the end of the current

Question:

Jet Ltd has been in business for 5 years. The ledger at the end of the current year shows: accounts receivable \($30\) 000, sales \($180\) 000, and allowance for doubtful debts with a debit balance of \($2000.\) After ageing the accounts receivable, bad debts are estimated to be 10% of accounts receivable. Prepare the entry necessary to adjust the allowance for doubtful debts.

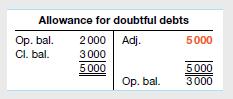

The debit of \($5000\) to bad debts expense is calculated as follows:

Receivables are to be reported net of allowance for doubtful debts. The allowance reflects the current best estimate of any amount the entity does not expect it will collect. The estimated uncollectable amount should be recorded in an allowance account.

Step by Step Answer:

Financial Accounting Reporting, Analysis And Decision Making

ISBN: 9780730363279

6th Edition

Authors: Shirley Carlon