On 1 January 2022, Markon plc took out a finance lease for new plant. Details of the

Question:

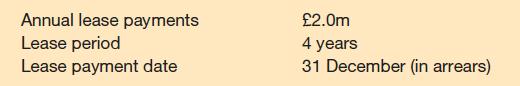

On 1 January 2022, Markon plc took out a finance lease for new plant. Details of the lease are as follows:

The business has a reporting-year-end date of 31 December. The non-cancellable part of the lease covers the four annual lease payments. The implicit interest rate in the lease is 12 per cent per year.

The business incurred £0.2 million in preparing the site for the new plant and expects to incur a further £0.3 million in removing the plant at the end of the lease period and making good the site. A deposit of £1.0 million was paid to the lessor at the commencement of the lease and £0.1 million was spent in securing and negotiating the lease.

Required:

Calculate at the commencement date of the lease:

(a) the lease liability;

(b) the cost of the plant.

Step by Step Answer:

Financial Accounting For Decision Makers

ISBN: 9781292409184

10th Edition

Authors: Peter Atrill, Eddie McLaney