As on 31st March 2017, the breakup of borrowed funds of Sabse Taza Retails Limited is as

Question:

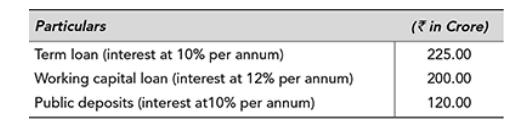

As on 31st March 2017, the breakup of borrowed funds of Sabse Taza Retails Limited is as follows:

The term loan is secured against the mortgage of company’s fixed assets, whereas the working capital loan is secured by way of hypothecation of its current assets. Public deposits are unsecured and are repayable on demand. The first instalment for repayment of term loan amounting to ₹ 25 crore is due within the next 12 months. Interest on term loan and working capital loan has accrued (but not due) for one quarter. Interest on public deposits amounting to ₹ 6 crore is due but not paid. How will the above information appear in the balance sheet of the company on 31st March 2017?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: