Question:

Container Corporation of India Ltd. (CONCOR) commenced operation from November 1989. It is now an undisputed market leader having the largest network of 68 inland containers depots (ICDs). In addition to providing inland transport by rail for containers, it has also expanded to cover management of ports, air cargo complexes and establishing cold-chain. Out of total 68 terminals, 13 are exportimport container depots and 17 exclusive domestic container depots and as many as 37 terminals perform the combined role of domestic as well as international terminals.

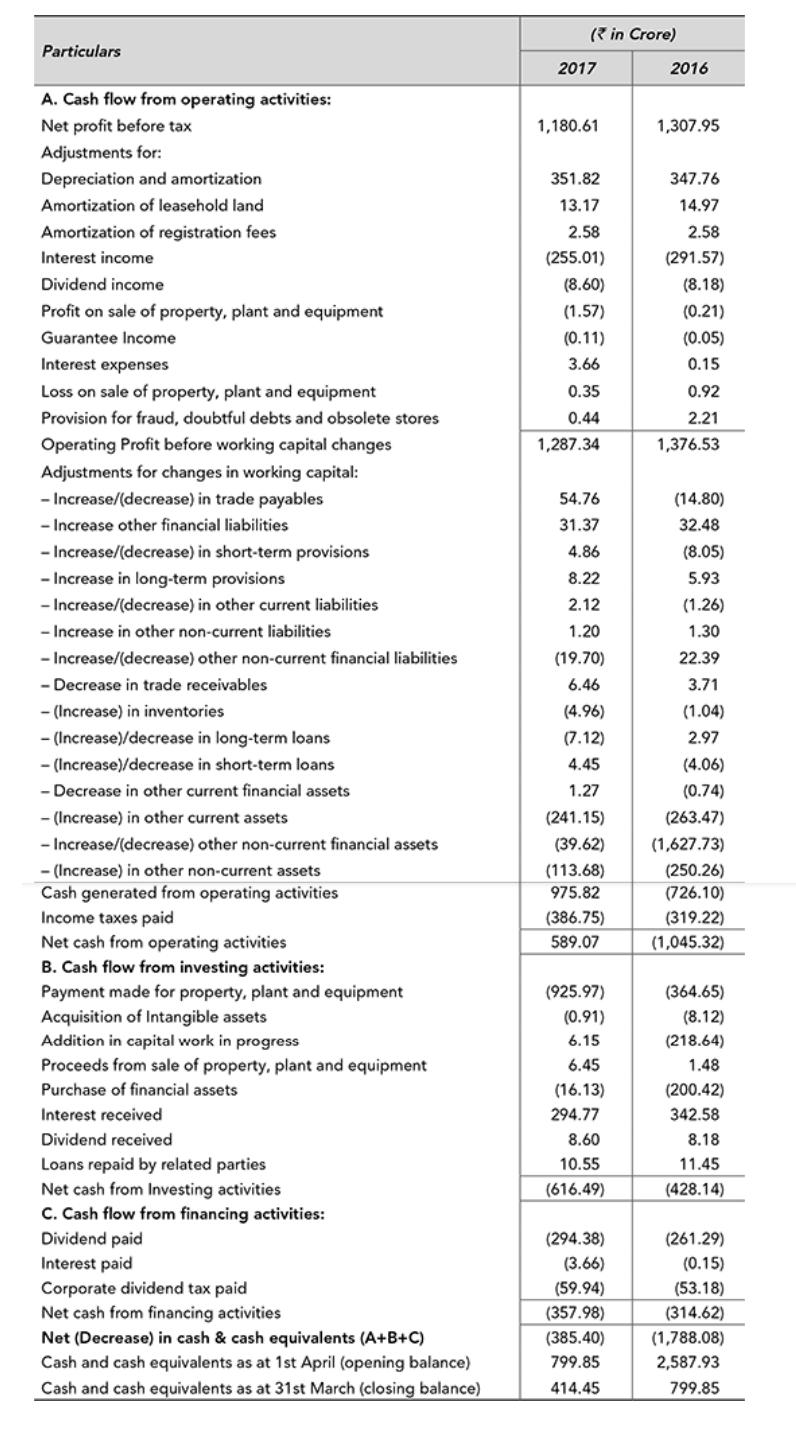

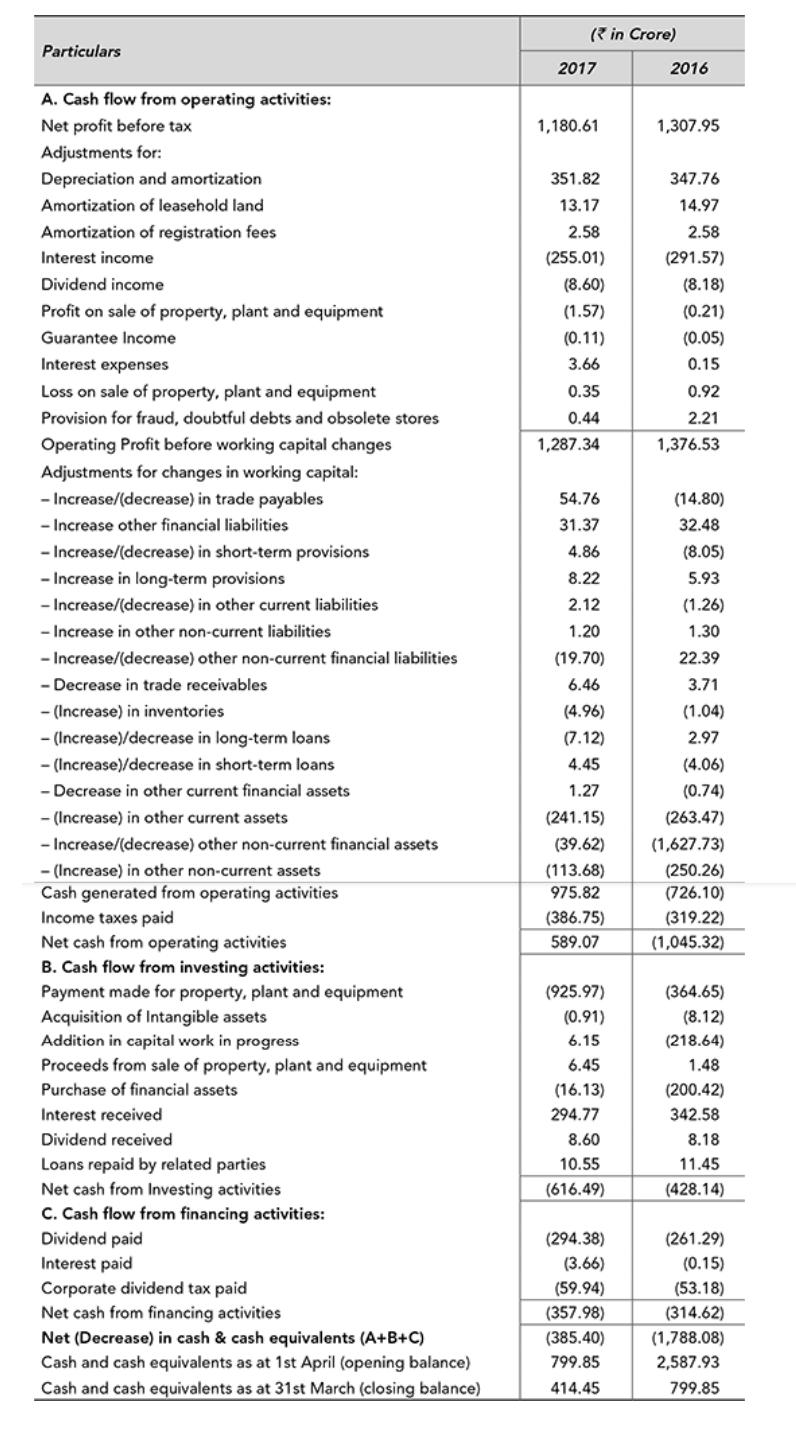

The company reported profit before tax (PBT) of ₹ 1,180.61 crore and ₹ 1,307.95 crore for the year 2016–17 and 2015–16, respectively. However, the cash and cash equivalents have declined from ₹ 2,587.93 crore as on 1st April 2015 to ₹ 4,14.45 crore as on 31st March 2017.

The statement of cash flow of the company for the year 2016–17 with comparative figures for the previous year is presented below:

Statement of Cash Flow for the Year Ended 31st March 31 2017

Questions for Discussion

1. Identify the main reasons for the decline in cash and cash equivalents in the last two years despite strong profit before tax.

2. For the year 2015–16, the company reported profit before tax (PBT) of ₹ 1,307.95 crore. However, cash flow from operating activities was (₹ 1,045.32) crore. Identify the main reasons for the negative cash flow from operating activities during the year.

3. In 2016–17, the company deducted interest income while calculating cash flow from operating activities and added interest received in cash flow from investing activities. Explain the reason for this treatment.

4. For 2016–17, the company had positive adjustment in respect of trade receivables and trade payables and negative adjustment in respect of inventories in the cash flow from operating activities. Explain reasons for the same.

5. The company has negative net cash flow from investing activities in both the years. What does it indicate?

6. There is no cash flows (inflows or outflows) relating to borrowings or equity in the cash flow from financing activities. What does it indicate?

Transcribed Image Text:

Particulars

A. Cash flow from operating activities:

Net profit before tax

Adjustments for:

Depreciation and amortization

Amortization of leasehold land

Amortization of registration fees

Interest income

Dividend income

Profit on sale of property, plant and equipment

Guarantee Income

Interest expenses

Loss on sale of property, plant and equipment

Provision for fraud, doubtful debts and obsolete stores

Operating Profit before working capital changes

Adjustments for changes in working capital:

- Increase/(decrease) in trade payables

- Increase other financial liabilities

- Increase/(decrease) in short-term provisions

- Increase in long-term provisions

- Increase/(decrease) in other current liabilities

- Increase in other non-current liabilities

- Increase/(decrease) other non-current financial liabilities

- Decrease in trade receivables

- (Increase) in inventories

- (Increase)/decrease in long-term loans

- (Increase)/decrease in short-term loans

- Decrease in other current financial assets

- (Increase) in other current assets

- Increase/(decrease) other non-current financial assets

- (Increase) in other non-current assets

Cash generated from operating activities

Income taxes paid

Net cash from operating activities

B. Cash flow from investing activities:

Payment made for property, plant and equipment

Acquisition of Intangible assets

Addition in capital work in progress

Proceeds from sale of property, plant and equipment

Purchase of financial assets

Interest received

Dividend received

Loans repaid by related parties

Net cash from Investing activities

C. Cash flow from financing activities:

Dividend paid

Interest paid

Corporate dividend tax paid

Net cash from financing activities

Net (Decrease) in cash & cash equivalents (A+B+C)

Cash and cash equivalents as at 1st April (opening balance)

Cash and cash equivalents as at 31st March (closing balance)

( in Crore)

2017

1,180.61

351.82

13.17

2.58

(255.01)

(8.60)

(1.57)

(0.11)

3.66

0.35

0.44

1,287.34

54.76

31.37

4.86

8.22

2.12

1.20

(19.70)

6.46

(4.96)

(7.12)

4.45

1.27

(241.15)

(39.62)

(113.68)

975.82

(386.75)

589.07

(925.97)

(0.91)

6.15

6.45

(16.13)

294.77

8.60

10.55

(616.49)

(294.38)

(3.66)

(59.94)

(357.98)

(385.40)

799.85

414.45

2016

1,307.95

347.76

14.97

2.58

(291.57)

(8.18)

(0.21)

(0.05)

0.15

0.92

2.21

1,376.53

(14.80)

32.48

(8.05)

5.93

(1.26)

1.30

22.39

3.71

(1.04)

2.97

(4.06)

(0.74)

(263.47)

(1,627.73)

(250.26)

(726.10)

(319.22)

(1,045.32)

(364.65)

(8.12)

(218.64)

1.48

(200.42)

342.58

8.18

11.45

(428.14)

(261.29)

(0.15)

(53.18)

(314.62)

(1,788.08)

2,587.93

799.85