HCL Technologies Limited is a leading IT solution provider company with operations is 32 countries and 116,000

Question:

HCL Technologies Limited is a leading IT solution provider company with operations is 32 countries and 116,000 employees. The global revenue of the company exceeded USD 7.2 billion. HCL Technologies provides solutions built around digital, IoT, cloud, automation, cybersecurity, analytics, infrastructure management and engineering services.

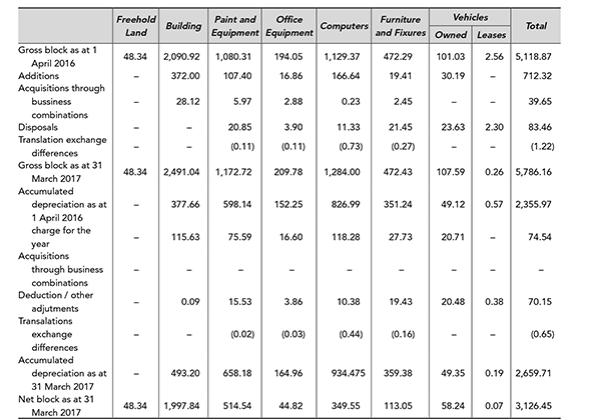

The carrying amount of property, plant and equipment (PPE) increased from ₹ 2,762.90 crore as on 31st March 2016 to ₹ 3,126.45 crore as on 31st March 2017. During the same period, the capital workinprogress declined from ₹ 582.12 crore to ₹ 410.53 crore.

Details of the PPE as provided in Note 3 to the balance sheet are reproduced below:

Some of key accounting policies relating to accounting for property, plant and equipment of the company are:

• Property, plant and equipment are stated at cost less accumulated depreciation and impairment losses, if any. Cost comprises the purchase price and directly attributable cost of bringing the asset to its working condition for its intended use. Any trade discounts and rebates are deducted in arriving at the purchase price. The company identifies and determines separate useful lives for each major component of the property, plant and equipment if they have a useful life that is materially different from that of the asset as a whole.

• Gains or losses arising from derecognition of assets are measured as the difference between the net disposal proceeds and the carrying amount of the asset and are recognized in the statement of profit and loss when the asset is derecognized.

• Property, plant and equipment under construction and cost of assets not ready for use at the yearend are disclosed as capital workinprogress.

• Depreciation on property, plant and equipment is provided on the straight line method over their estimated useful lives, as determined by the management. Depreciation is charged on a prorata basis for assets purchased/sold during the year.

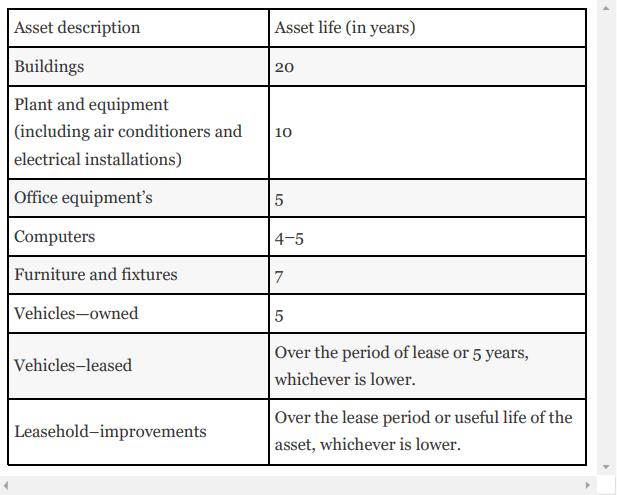

• The management’s estimates of the useful lives of various assets for computing depreciation are as follows:

• The useful lives as given above best represent the period over which the management expects to use these assets, based on technical assessment. The estimated useful lives for these assets are therefore different from the useful lives prescribed under Part C of Schedule II of the Companies Act, 2013.

• The residual values, useful lives and methods of depreciation of property, plant and equipment are reviewed at the end of each financial year and adjusted prospectively, if appropriate.

• Borrowing costs directly attributable to the acquisition, construction or production of an asset that necessarily takes a substantial period of time to get ready for its intended use or sale are capitalized as part of the cost of the asset.

• Intangible assets and property, plant and equipment are evaluated for recoverability whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. If such assets are considered to be impaired, the impairment to be recognized in the statement of profit and loss is measured by the amount by which the carrying value of the asset exceeds the estimated recoverable amount of the asset.

Questions for Discussion

1. Explain the expression capital workinprogress. Why is there a decline in the carrying amount of the same?

2. The company is using cost model for the subsequent measurement of PPE. How is it different from the revaluation model?

3. State the principle for the initial measurement of PPE. What costs are included in the initial measurement?

4. What is the treatment of subsequent expenditure on property, plant and equipment?

5. How is depreciation different from impairment?

6. Why are the borrowing costs capitalized?

Step by Step Answer: