Ram Bharose Limited, a steel trader follows a very liberal credit policy of allowing 120 days to

Question:

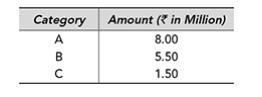

Ram Bharose Limited, a steel trader follows a very liberal credit policy of allowing 120 days to its customer to pay against their purchases. This policy has helped the company in attracting new customers but at the same time results in a high incidence of bad debts. As on 31st March 2017, the company has total debtors of ₹15 million. The company classifies its customers in three categories A, B and C based upon their credit worthiness. The breakup of ₹15 million of sundry debtors is given as follows:

Based upon the past experience, it is estimated that 2% of Category A, 3% of Category B and 5% of Category C may not pay when due and have to be provided for.

What will be the impact of the above in the profit and loss statement for the year and balance sheet as on 31st March 2017.

Step by Step Answer: