Consider a publicly held company whose products you are familiar with. Some examples might include: Access the

Question:

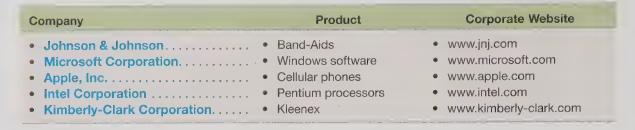

Consider a publicly held company whose products you are familiar with. Some examples might include:

Access the company’s public website and search for its most recent annual report. (Some companies provide access to their financial data through an “investor relations” link, while others provide a direct link to their “annual reports.””) After locating your company’s most recent annual report, open the file and review its contents. After reviewing the annual report for your selected company, prepare answers to the following questions:

a. Does the company have any short-term investments or marketable securities? If so, are they trading securities or available-for-sale securities? Over the past year, did the company experience any unrealized gains or losses on its marketable securities? If so, in what amount?

b. Does the company have any unconsolidated affiliates or joint ventures? If so, how are they accounted for? Did the unconsolidated affiliates or joint ventures produce a profit or loss last year?

c. Does the company have any consolidated subsidiaries? If so, how many? Does the company own 100 percent of all of its consolidated subsidiaries? How were you able to determine this?

d. Does the company have any goodwill from prior acquisitions? How does the company account for its goodwill? Has the goodwill been impaired in either of the last two years? If so, what amount was the impairment?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris