The 2014 financial statements of LVMH Moet Hennessey-Louis Vuitton S.A. are presented in Appendix C of this

Question:

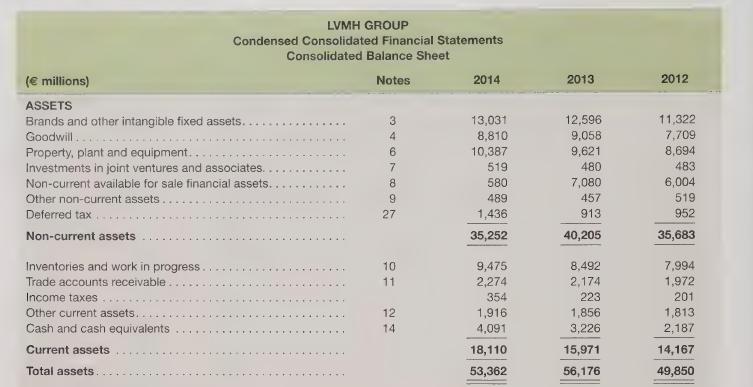

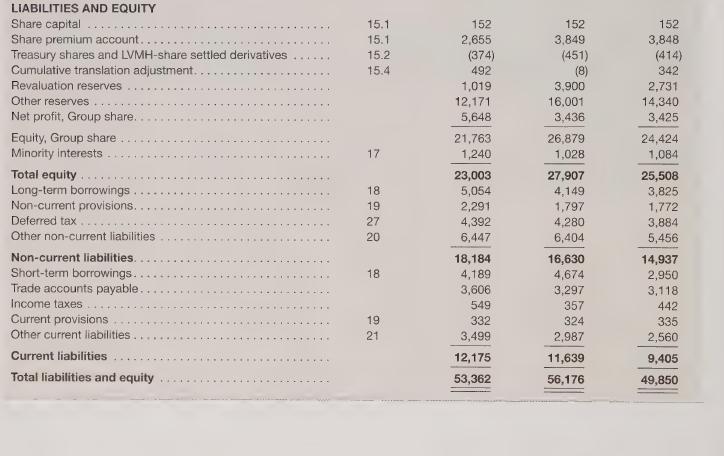

The 2014 financial statements of LVMH Moet Hennessey-Louis Vuitton S.A. are presented in Appendix C of this book. LVMH is a Paris-based holding company and one of the world’s largest and best-known luxury goods companies. As a member-nation of the European Union, French companies are required to prepare their consolidated (group) financial statements using International Financial Reporting Standards (IFRS). In LVMH’s Notes to the Consolidated Financial Statements (not presented in Appendix C), the company discloses its method of consolidation:

How does LVMH’s consolidation policy differ from U.S. GAAP?

Appendix C:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris

Question Posted: