Consider a publicly-held company whose products you are familiar with. Some examples might include: Access the companys

Question:

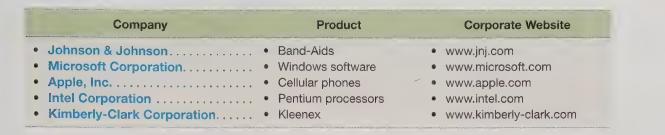

Consider a publicly-held company whose products you are familiar with. Some examples might include:

Access the company’s public website and search for its most recent annual report. (Some companies will provide access to their financial data through an “investor relations” link, while others will provide a direct link to their “annual reports.”) After locating your company’s most recent annual report, open the file and review its contents. After reviewing the annual report for your selected company, prepare answers to the following questions:

a. Calculate the cost of goods sold, operating expenses, and net income as a percentage of net sales for the last two years. What is the trend in each of these percentages? Explain what might be driving the trend.

b. Calculate the company’s total liabilities as a percentage of total assets for the last two years. Did this percentage increase or decrease? Is the company principally debt-financed or equity-financed?

c. Determine if the company paid dividends to its shareholders. (Look at the statement of shareholders’

equity or the statement of cash flow.) If the company paid dividends, calculate the ratio of dividends paid divided by net income. (This ratio is known as the dividend payout ratio.) What percentage of its net income did the company pay to its shareholders in each of the last two years?

d. Review the company’s statement of cash flow. Identify the major sources of financing used by the company in each of the last two years.

e. Review the company’s “Summary of Significant Accounting Policies.” Identify how the company recognizes revenue. Identify if the company uses any estimates in the preparation of its financial statement, and if so, prepare a list of the estimates used in its financial report.

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris