Graham Inc. acquired all of the outstanding shares of Mahoney Inc. through an exchange of common shares.

Question:

Graham Inc. acquired all of the outstanding shares of Mahoney Inc. through an exchange of common shares. The aggregate fair value of the Graham shares distributed to the Mahoney shareholders was \($400,000\). Further, at the time of the exchange, the fair value of Mahoney’s net assets was equal to their book value, except for Mahoney’s property and equipment, which was appraised at \($540,000\).

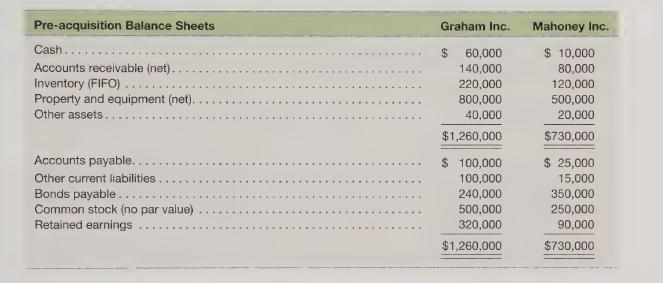

Presented below are the pre-acquisition balance sheets of the two companies:

Required

Prepare the consolidated balance sheet for the new company immediately following the transaction.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris

Question Posted: