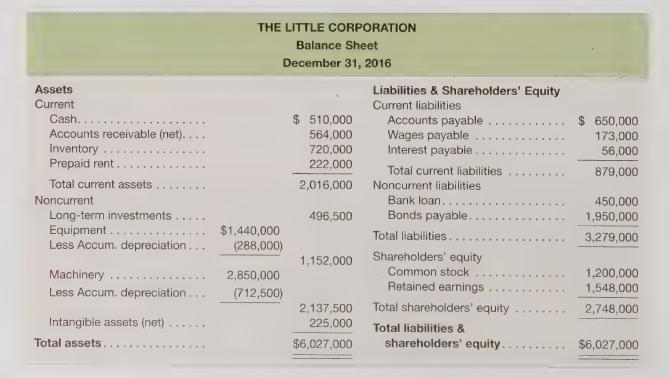

Presented below is the year-end 2016 balance sheet for The Little Corporation. During 2017, the company entered

Question:

Presented below is the year-end 2016 balance sheet for The Little Corporation.

During 2017, the company entered into the following events:

1. Sales to customers totaled \($2\) million, of which \($1.6\) million were on credit and the remainder was cash sales. The cost of goods sold totaled \($800,000\).

2. Purchased \($700,000\) of inventory on credit.

3. Paid \($620,000\) cash to employees as wages. (This amount includes the wages payable at December 31, 2016.)

4. Collected \($1.75\) million cash from customers as payment on outstanding accounts receivable.

5. Paid \($1.2\) million cash to suppliers on outstanding accounts payable.

6. Sold machinery for \($120,000\) cash on January 1, 2017. The machinery had cost \($370,000\) and at the time of sale it had a net book value of \($160,000\).

7. Paid miscellaneous expenses totaling \($98,000\) cash.

8. Sold common stock for \($450,000\) cash.

9. Invested \($200,000\) of excess cash in short-term marketable securities.

10. Declared and paid a cash dividend of \($100,000\).

As part of the year-end audit, the internal audit staff identified the following additional information:

a. \($180,000\) of prepaid rent was consumed during the year.

b. The equipment had a useful life of 10 years and the machinery of 20 years. The company uses straightline depreciation. (No depreciation should be recorded for machinery in Item 6 above.)

c. The intangible assets had a remaining useful life of 10 years.

d. Interest on the bank loan and bonds payable was 10 percent. During the year, interest payments totaling \($260,000\) had been paid in cash.

Required:

1. Using the balance sheet equation as illustrated in this chapter, prepare a spreadsheet reflecting the events of The Little Corporation during 2017.

2. Prepare the income statement for 2017.

3. Prepare the statement of shareholders’ equity, balance sheet, and statement of cash flow for 2017.

4. How has the company’s use of leverage changed from 2016 to 2017?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris