Santiago, Inc., began operations as an importer of fine Chilean wine the United States. Sales and purchase

Question:

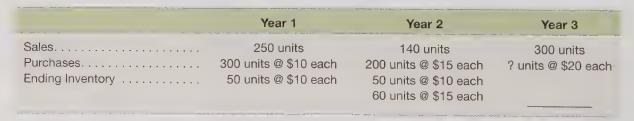

Santiago, Inc., began operations as an importer of fine Chilean wine the United States. Sales and purchase information is provided below.

Santiago, Inc., uses the LIFO method of inventory valuation. The purchase amount for Year 3 has been left blank because the company has not yet decided the total number of units to purchase during the year. (Assume that all sales occur on the last day of the year, after all purchases for the year have been made. The company’s year-end is December 31.)

Required

1. How many units should be purchased in Year 3 if the firm’s objective is to minimize income taxes for the year?

2. Compute the cost of goods sold for Year 3 assuming that the number of units computed in (1) is purchased.

3. How many units should be purchased in Year 3 if the firm’s objective is to maximize reported income for the year?

4. Compute the cost of goods sold for Year 3 assuming that the number of units computed in (3) is purchased.

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris