Presented below are the financial statements of two companies that are identical in every respect except the

Question:

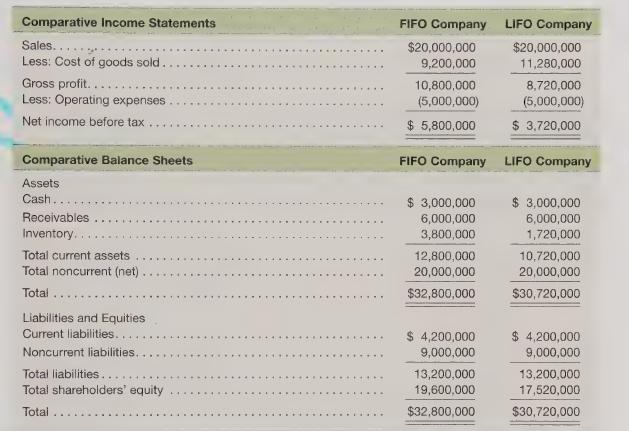

Presented below are the financial statements of two companies that are identical in every respect except the method of valuing their inventories. The method of valuing inventory is LIFO for the LIFO Company and FIFO for the FIFO Company.

Required

Using the two sets of financial statements, calculate the ratios below for each firm. Ignore the effect of taxes (i.e., assume zero taxes for both firms).

1. Current ratio

2. Inventory turnover

3. Inventory-on-hand period

4. Return on assets

5. Total debt to total assets

6. Long-term debt to shareholders’ equity

7. Gross profit margin ratio

8. Return on sales

9. Return on shareholders’ equity

10. Earnings per share (assume 2 million shares outstanding)

Based on the above ratios, which company represents the better investment opportunity? The better acquisition opportunity? The better lending opportunity? Why?

Step by Step Answer:

Financial Accounting For Executives And MBAs

ISBN: 9781618531988

4th Edition

Authors: Wallace, Simko, Ferris