Good Vibes Products manufactures external drives for computers. The company has two production departments. Overhead in Department

Question:

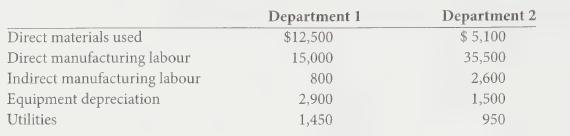

Good Vibes Products manufactures external drives for computers. The company has two production departments. Overhead in Department | is allocated based on 10,000 machine hours and overhead in Department 2 is allocated based on 6,000 direct labour hours. The budgeted manufacturing overhead for July, 2011, was \($58,000\) and \($54,000\) for Departments 1 and 2, respectively. During July, the company completed a number of jobs, one of which (Job 110) incurred the following costs:

Job 110 incurred 800 machine hours in Department 1 and 1,000 labour hours in Department 2.

The company uses a budgeted department overhead rate in allocating overhead to jobs.

a. What is the budgeted manufacturing overhead rate for Department 1?

b. What is the budgeted manufacturing overhead rate for Department 2?

c. What is the total cost of Job 110 using allocated overhead rates?

d. What is the over- or underallocated overhead for Job 110?

e. Explain why Good Vibes uses different overhead bases for Departments 1 and 2.

Step by Step Answer:

Accounting For Managers Interpreting Accounting Information For Decision Making

ISBN: 9781118037966

1st Canadian Edition

Authors: Paul M. Collier, Sandy M. Kizan, Eckhard Schumann