Key figures for Apple and Google follow. Required 1. Compute the debt-to-equity ratios for Apple and Google

Question:

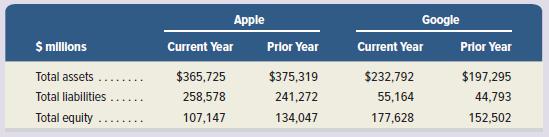

Key figures for Apple and Google follow.

Required

1. Compute the debt-to-equity ratios for Apple and Google for both the current year and the prior year.

2. Use the ratios from part 1 to determine which company’s financing structure is less risky.

3. Is its debt-to-equity ratio more risky or less risky compared to the industry (assumed) average of 0.5 for

(a) Apple

(b) Google?

Transcribed Image Text:

Apple Google $ millons Prior Year Prlor Year Current Year Current Year Total assets $365,725 $375,319 $232,792 $197,295 Total liabilities 258,578 241,272 55,164 44,793 Total equity 107,147 134,047 177,628 152,502 .....

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (12 reviews)

ANSWER 1 Compute the debttoequity ratios for Apple and ...View the full answer

Answered By

Aketch Cindy Sunday

I am a certified tutor with over two years of experience tutoring . I have a passion for helping students learn and grow, and I firmly believe that every student has the potential to be successful. I have a wide range of experience working with students of all ages and abilities, and I am confident that I can help students succeed in school.

I have experience working with students who have a wide range of abilities. I have also worked with gifted and talented students, and I am familiar with a variety of enrichment and acceleration strategies.

I am a patient and supportive tutor who is dedicated to helping my students reach their full potential. Thank you for your time and consideration.

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Accounting Information For Decisions

ISBN: 9781260705584

10th Edition

Authors: John J. Wild

Question Posted:

Students also viewed these Business questions

-

Key figures for Apple and Google follow. *Apple did not report interest expense for these periods. Amounts included in this table are assumed for purposes of this analysis. Required 1. Compute times...

-

Key comparative figures for Apple and Google follow. 1. What is the debt ratio for Apple in the current year and for the prior year? 2. What is the debt ratio for Google in the current year and for...

-

Key figures for Apple and Google follow ($ millions). Required 1. Compute the ratio of segment revenue divided by segment assets for each of the segments of Apple and Google for the most recent year...

-

How could a company's "green" policies affect their reputation management and community-building strategies, both positively and negatively?

-

Estimate the temperature at which strontium carbonate begins to decompose to strontium oxide and CO2 at 1 atm. SrCO3(s) SrO(s) + CO2(g) Use thermodynamic data in Appendix C.

-

Redo Example 5, assuming that there is no upward lift on the plane generated by its wings. Without such lift, the guideline slopes downward due to the weight of the plane. For purposes of significant...

-

In the Bohr model of the hydrogen atom, an electron orbits a nucleus consisting of one proton. Given that the electron and proton are both spinning, describe the types of magnetic interactions you...

-

A local partnership is to be liquidated. Commissions and other liquidation expenses are expected to total $19,000. The businesss balance sheet prior to the commencement of liquidation is asfollows:...

-

10.A positively charged particle of specific charge , accelerated by a potential difference V moves through a uniform transverse magnetic field

-

1. Was there any indication that Doughney was cybersquatting? 2. Could Doughney have avoided liability by making changes to his website or business model? What changes might have helped shield him...

-

Brussels Enterprises issues bonds at par dated January 1, 2020, that have a $3,400,000 par value, mature in four years, and pay 9% interest semiannually on June 30 and December 31. 1. Record the...

-

Separately analyze transactions a and b from QS 10-2 by showing their effects on the accounting equation specifically, identify the accounts and amounts (including + or ) for each transaction. QS...

-

A and B are complementary. Find mA and mB. mZA= (3x + 2) m/B= (x-4)

-

show the complete answer 1. Mr.Tan invested Php 35, 000 and had Php 39, 250 returned to him 2 years and 9 months later. At what simple interest rate did his money earn? 2. Nicole needs to raise Php...

-

Two point charges 1C and -1C are placed 5 mm away from each other forming a dipole. What will be the field intensity at a point 15 cm away from the dipole on its axis?

-

Mary, a cash basis individual, is awarded a $10,000 bonus on December 1, 20X1. The money is set aside for her in a special account that she can immediately draw upon at any time up until January 31,...

-

On December 31, 20X1, cash basis taxpayer Alice sells property and receives a secured note, due in 20X5. The face of the note is $10,000 and the FMV of the note is $8,000. Alice's basis in the sold...

-

When creating a general journal do I include invoices where no money has been paid or received? Such as in transaction 1 and 3 in the images included. If I do include them, how would I go about...

-

A linear transformation S: U U is called skew-adjoint if S* = -S. (a) Prove that a skew-symmetric matrix is skew-adjoint with respect to the standard dot product on Rn. (b) Under what conditions is...

-

Horse serum containing specific antibody to snake venom has been a successful approach to treating snakebite in humans. How do you think this anti-venom could be generated? What are some advantages...

-

Refer to QS 3-6 and compute the total equivalent units of production with respect to labor for March using the FIFO inventory method.

-

Match each of the following items A through G with the best numbered description of its purpose. A. Raw Materials Inventory account B. Materials requisition C. Finished Goods Inventory account D....

-

Match each of the following items A through G with the best numbered description of its purpose. A. Raw Materials Inventory account B. Materials requisition C. Finished Goods Inventory account D....

-

2.20 Consider the equation ex - x - 1 = 0. (a) Sketch the functions in this equation and then use this to explain why there are only two solutions to this equation and describe where they are located...

-

Zoe earned $45. She needs twice that much for her vacation. What is the total amount she needs for her vacation?

-

Liana would like to earn $500 each month at her part-time job. So far this month she has earned $342.46. How much more must she earn to reach her goal?

Study smarter with the SolutionInn App