Refer to the balance sheet data in QS 12-10 from Anders Company. During 2020, a building with

Question:

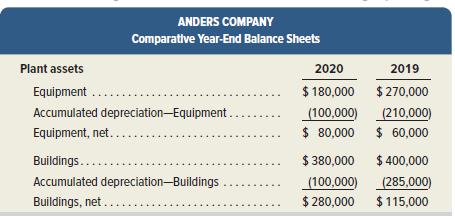

Refer to the balance sheet data in QS 12-10 from Anders Company. During 2020, a building with a book value of $70,000 and an original cost of $300,000 was sold at a gain of $60,000.

1. How much cash did Anders receive from the sale of the building?

2. How much depreciation expense was recorded on buildings during 2020?

3. What was the cost of buildings purchased by Anders during 2020?

QS 12-10

Transcribed Image Text:

ANDERS COMPANY Comparative Year-End Balance Sheets Plant assets 2020 2019 Equipment .... $ 180,000 $ 270,000 Accumulated depreciation-Equipment. (100,000) (210,000) Equipment, net... $ 80,000 $ 60,000 Buildings.... $ 380,000 $ 400,000 Accumulated depreciation-Buildings (100,000) $ 280,000 (285,000) $ 115,000 Buildings, net.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 38% (13 reviews)

Anders Company received 130000 cash from the sale of the building 70000 book value ...View the full answer

Answered By

Maurat Ivan

I have been working in the education and tutoring field for the past five years, and have gained a wealth of experience and knowledge in this area. I have a bachelor's degree in education, and have completed additional coursework in teaching and tutoring.

In my previous roles, I have worked as a teacher in both private and public schools, teaching a variety of subjects including math, science, and English. I have also worked as a private tutor, providing one-on-one tutoring to students in need of additional support and guidance.

In my current role, I work as an online tutor, providing virtual tutoring services to students around the world. I have experience using a variety of online tutoring platforms and technologies, and am comfortable working with students of all ages and skill levels.

I am passionate about helping students succeed and reach their full potential, and I believe that my education and tutoring experience make me an excellent candidate for a tutoring job at SolutionInn. I am confident that my knowledge, skills, and experience will enable me to provide top-quality tutoring services to students on the SolutionInn platform.

0.00

0 Reviews

10+ Question Solved

Related Book For

Financial Accounting Information For Decisions

ISBN: 9781260705584

10th Edition

Authors: John J. Wild

Question Posted:

Students also viewed these Business questions

-

Refer to the balance sheet and income statement for Abercrombie Supply Company for the year ended June 30, 2017. Calculate the following ratios: a. Inventory turnover. b. Days sales outstanding. c....

-

Refer to the balance sheet data above from Anders Company. During 2015, a building with a book value of $70,000 and an original cost of $300,000 was sold at a gain of $60,000. a. How much cash did...

-

Refer to the balance sheet and income statement for Research In Motion in Appendix A. What does the company title its inventory account? Does the company present a detailed calculation of its cost of...

-

To encourage _________, leaders are encouraged to study the principles of teamwork that prevail in clinical contexts for their application to managerial planning and decision-making contexts....

-

Unlabeled test tubes contain solid AlCl3 6H2O in one, Ba(OH)2 8H2O in another, and MgSO4 7H2O in the other. How could you find out what is in each test tube, using chemical tests that involve only...

-

Find the energy (in joules) of the photon that is emitted when the electron in a hydrogen atom undergoes a transition from the n = 7 energy level to produce a line in the Paschen series.

-

Catastrophe Management Solutions is a customer service support center for insurance companies. In 2010, the company put out a help wanted ad for customer service representatives who had basic...

-

From the following accounts, prepare a balance sheet for Chester Co. for the current calendar year. Accrued interest payable..........$ 1,400 Property, plant, and equipment.......34,000...

-

How do you print the first value in a tuple called aVar?

-

Mrs. Meadows sells two popular brands of cookies, Chip Dip and Soft Chunk Chocolate Chip. Both cookies go through the mixing and baking departments, but Chip Dip is also dipped in chocolate in the...

-

Use the following information to determine cash flows from investing activities. a. Equipment with a book value of $65,300 and an original cost of $133,000 was sold at a loss of $14,000. b. Paid...

-

The following financial statements and additional information are reported. (1) Prepare a statement of cash flows using the indirect method for the year ended June 30, 2020. (2) Compute the companys...

-

The central rates for the Spanish and Belgian currencies on March 20, 1997, were Ptas 163.826/ECU and BF 39.7191/ECU. What central cross rate between these two currencies did these central rates...

-

1. Determine the Boolean expression in sum-of-products form for the following truth table. Do not simplify your answer. A B C D 0 0 0 1 0 0 1 1 0 1 0 1 0 1 1 0 1 0 0 1 1 0 1 1 1 1 1 1 0 1 0 0 2. (0.5...

-

How does ethnocentrism manifest in the context of cultural anthropology and sociology, particularly concerning the evaluation of other societies based on one's own cultural standards?

-

What is the purpose of the revaluation reserve account? When should the account be debited and when will it be credited?

-

Dunder Mifflin started the month of June with $ 1 2 2 , 8 8 9 in assets. During the month of June, they bought $ 7 0 , 0 6 4 worth of paper on account and received $ 2 4 , 7 4 1 from a customer on...

-

Translate each English sentence in the following problem into an algebraic expression and establish the related equation.Let x be the unknown number. Some number minus 6 is equal to the product of...

-

Let R2 be a line, and p a point. A perspective map takes a point x R2 to the point q that is the intersection of with the line going through p and x. If the line is parallel to then the map is not...

-

When the concentration of a strong acid is not substantially higher than 1.0 10-7 M, the ionization of water must be taken into account in the calculation of the solution's pH. (a) Derive an...

-

Health Drinks Company produces two beverages, PowerPunch and SlimLife. Data about these products follow. Additional data from its two production departments follow. Required 1. Determine the cost of...

-

Keith Riggins expects an investment of $82,014 to return $10,000 annually for several years. If Riggins earns a return of 10%, how many annual payments will he receive? (Use Table B.3.)

-

Keith Riggins expects an investment of $82,014 to return $10,000 annually for several years. If Riggins earns a return of 10%, how many annual payments will he receive? (Use Table B.3.)

-

Briefly explain SQL Server replication and HA cluster? Please don't forget to include different replication options (types of replications) available to you as a DBA. What are some differences...

-

For SQL Server what login type do you prefer? Window or SQL Server authentication? Why? Provide a brief explanation? Assume you have access to Window Active Directory Service

-

I need an executive summary for the following below in paragraph form: Integration of Microsoft Dynamics and Net Suite into SQL Server for American Enterprises, Inc American Enterprises, Inc is...

Study smarter with the SolutionInn App