Refer to Simon Companys financial information in Exercises 13-6 and 13-8. Evaluate the companys efficiency and profitability

Question:

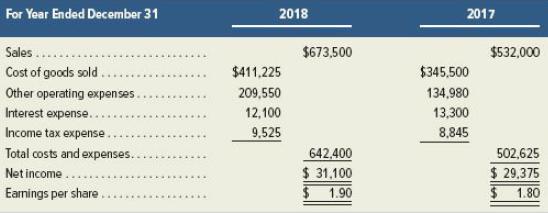

Refer to Simon Company’s financial information in Exercises 13-6 and 13-8. Evaluate the company’s efficiency and profitability by computing the following for 2018 and 2017:

(1) Profit margin ratio—percent rounded to one decimal,

(2) Total asset turnover—rounded to one decimal,

(3) Return on total assets—percent rounded to one decimal. Comment on these ratio results.

Exercises 13-6

Exercises 13-8

Transcribed Image Text:

At December 31 2018 2017 2016 Assets Cash... $ 31,800 $ 35,625 $ 37,800 Accounts receivable, net.. 89,500 62,500 50,200 Merchandise inventory.. 112,500 82,500 54,000 Prepaid expenses... Plant assets, net.. 10,700 9,375 5,000 278,500 255,000 230,500 Total assets.. $523.000 $445,000 $377,500 Liabilities and Equity Accounts payable..... $129,900 $ 75.250 $ 51,250 Long-term notes payable secured by mortgages on plant assets 98,500 101,500 83,500 Common stock, $10 par value. Retained earnings... Total liabilities and equity.. 163,500 163,500 163,500 79,250 104,750 $523.000 $445,000 $377,500 131,100

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 77% (9 reviews)

1 Profit margin 2018 31100 673500 46 2017 29375 532000 5...View the full answer

Answered By

AJIN kuriakose

I have completed B.Tech in Electrical Engineering & Masters in Power & Control From one of the best universities in India. I got the 99.05 percentile in the Gate Electrical Engineering Exam. I can Help students solving assignments in Electrical subjects like Power Electronics, Control system, Analog, Network Theory & Engineering Mathematics. Clear your fundamentals and develop problem-solving skills and analytical skills to crack the exam.

Get guidance and the opportunity to learn from experienced...

I can provide tuition for Electrical engineering subjects (Power Electronics, Digital electronics, Network Theory, Control System & Engineering Mathematics). The toughest subject of Electrical engineering can be made simple in online classes...

I can also solve it.

1 .I can help you with your assignments or exams or quiz or tutoring.

2. Very strict to the deadlines.

Message me for any help in assignments, live sessions. I am here to help students for all assignments, tests and exams and I will make sure you always get _95% In your subject.

Contact me in solution inn for any help in your semester, projects and for many more things . Also feel free to contact me through solution inn and for any advise related to tutoring and how it works here.thank you.

5.00+

5+ Reviews

10+ Question Solved

Related Book For

Financial Accounting Information for Decisions

ISBN: 978-1259917042

9th edition

Authors: John J. Wild

Question Posted:

Students also viewed these Business questions

-

Refer to Simon Company's financial information in Exercises 13-6 and 13-8. Evaluate the company's efficiency and profitability by computing the following for 2015 and 2014: (1) Profit margin...

-

Refer to Simon Company's financial information in Exercises 13-6 and 13-8. Additional information about the company follows. To help evaluate the company's profitability, compute and interpret the...

-

Refer to the information in Exercises 13 and 15 about Mixon Company. Compare the long-term risk and capital structure positions of the company at the end of 2006 and 2005 by computing the following...

-

Cungs Dress Delivery operates a mail-order business that sells clothes designed for frequent travelers. It had sales of $610,000 in December. Because Cungs Dress Delivery is in the mail order...

-

What is the purpose of the International HapMap Project? How will it help researchers who study disease-causing alleles?

-

1. Why did Tiffany become a takeover target? 2. Acquisitions are one tool to execute corporate strategy. Why did LVMH acquire Tiffany? In your answer, focus on product and geographic diversification....

-

The Cooper Furniture Company of Potomac, Maryland, assembles two types of chairs (Recliners and Rockers). Separate assembly lines are used for each type of chair. Classify each cost item (AI) as...

-

A beginning accounting student tried to complete a work sheet for Joyce Lee's Tax Service. The following adjusting entries were to have been analyzed and entered onto the work sheet. The work sheet...

-

Scenario 7:Accountant 7 is the audit manager of a distressed client. Our client is in true financialtrouble and they want our firm to lend them money. Can we?

-

3. The wave function of a particle trapped in an infinite square well potential of width 2a is found to be: TTX 1 = c [cos + sin *+cosx COS 2a 4 a = 0 2a inside the well outside the well i) Calculate...

-

The following selected information is from Princeton Company?s comparative balance sheets. The company?s net income for the year ended December 31, 2018, was $48,000. 1. Compute the cash received...

-

Use the indirect method to prepare the cash provided or used from operating activities section only of the statement of cash flows for this company. CRUZ, INC. Comparative Balance Sheets December 31,...

-

Professor Andersons university has 13,200 students, of which are 7,020 are undergraduates, 4,200 are master students, and 1,800 are Ph.D. students. He decides to randomly select 70 undergraduates, 42...

-

Man SE is a German commercial vehicle manufacturer. Its DPS and EPS for 2011 were 2 and 4.62, respectively. The RoE of the firm was 11.85 per cent and the share price is 99.63. How would you...

-

How do differences in the macro-environment affect corporate governance?

-

Is it possible to improve one governance principle in a firm but weaken another at the same time? Use an illustration to explain your answer.

-

After extensive medical and marketing research, Pill plc believes it can penetrate the pain reliever market. It is considering two alternative products. The first is a medication for headache pain....

-

Why would we expect managers of a corporation to pursue the objectives of shareholders? What about bondholders?

-

What is a VHWO's basis of accounting for unrestricted assets and restricted assets?

-

Solve each equation or inequality. |6x8-4 = 0

-

Crafton Manufacturing produces machine tools for the construction industry. The following details about overhead costs were taken from its company records. Additional information on the drivers for...

-

Kate Beckwith expects to invest $10,000 annually that will earn 8%. How many annual investments must Beckwith make to accumulate $303,243 on the date of the last investment? (Use Table B.4.)

-

Kate Beckwith expects to invest $10,000 annually that will earn 8%. How many annual investments must Beckwith make to accumulate $303,243 on the date of the last investment? (Use Table B.4.)

-

The Government is modernising the electricity grid to help put downward pressure on power prices and support the transformation to a clean energy future. Rewiring the Nation will use $20-billion of...

-

How do network analysis and relational sociology contribute to our understanding of social structure, by examining the patterns of social ties, connections, and interactions that underpin social...

-

A program has been started for you: student_project.java. You must finish the code to read data from a data file into the parallel arrays as follows: (the arrays are already defined in the code)...

Study smarter with the SolutionInn App