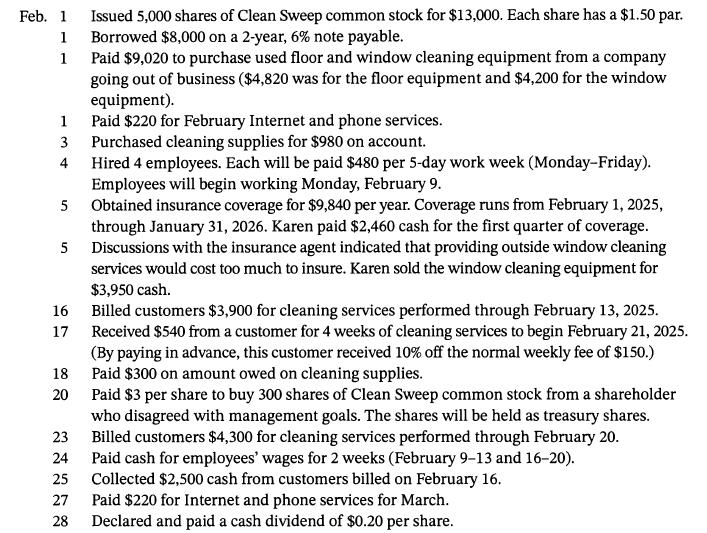

Karen Noonan opened Clean Sweep Inc. on February 1, 2025. During February, the following transactions were completed.

Question:

Karen Noonan opened Clean Sweep Inc. on February 1, 2025. During February, the following transactions were completed.

Instructions

a. Journalize the February transactions. (You do not need to include an explanation for each journal entry.)

b. Post to the ledger accounts (Use T-accounts.)

c. Prepare a trial balance at February 28, 2025.

d. Journalize the following adjustments. (Round all amounts to whole dollars.)

1. Services performed for customers through February 27,2025 , but unbilled and uncollected were .

2. Received notice that a customer who was billed for services performed February 10 has filed for bankruptcy. Clean Sweep does not expect to collect any portion of this outstanding receivable.

3. Clean Sweep uses the allowance method to estimate bad debts. Clean Sweep estimates that of its month-end receivables will not be collected.

4. Record 1 month of depreciation for the floor equipment. Use the straight-line method, an estimated life of 4 years, and salvage value.

5. Record 1 month of insurance expense.

6. An inventory count shows of supplies on hand at February 28.

7. One week of services were performed for the customer who paid in advance on February 17.

8. Accrue for wages owed through February 28, 2025.

9. Accrue for interest expense for 1 month.

10. Karen estimates a income tax rate.

e. Post adjusting entries to the T-accounts.

f. Prepare an adjusted trial balance.

g. Prepare a multiple-step income statement, a retained earnings statement, and a properly classified balance sheet as of February 28, 2025.

h. Journalize closing entries.

Step by Step Answer:

Financial Accounting Tools For Business Decision Making

ISBN: 9781119791089

10th Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Jill E. Mitchell