A, B and C were in partnership sharing profits and losses in the ratio 3 : 2

Question:

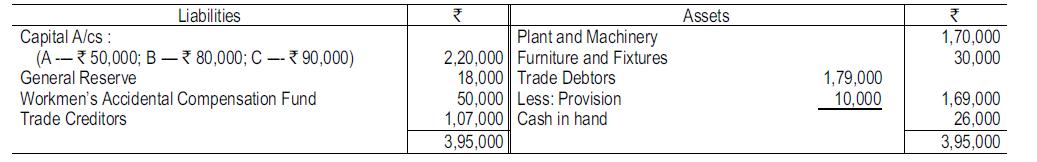

A, B and C were in partnership sharing profits and losses in the ratio 3 : 2 : 1. Their Balance Sheet as on 31.3.2018 was as follows :

C retired on that date. It was agreed that :

(a) Plant and machinery to be revalued at ₹1,94,000. Provision on debtors be kept at ₹19,000 and liability for workmen’s accident compensation was decided at ₹23,000.

(b) C should get, apart from other amounts due to him, his share in goodwill ₹40,000.

(c) The total amount payable to C was brought by A and B in their profit sharing ratio. Immediately after this, they admitted D as a partner on his bringing ₹80,000 as share in goodwill and ₹1,40,000 as capital. It was agreed that A and B, as between themselves, will share profits and losses equally.

You are required to prepare : (i) Revaluation Account; (ii) Partners’ Capital Accounts; (iii) Balance Sheet after all the adjustments are carried out.

Step by Step Answer:

Financial Accounting Volume II

ISBN: 9789387886230

4th Edition

Authors: Mohamed Hanif, Amitabha Mukherjee