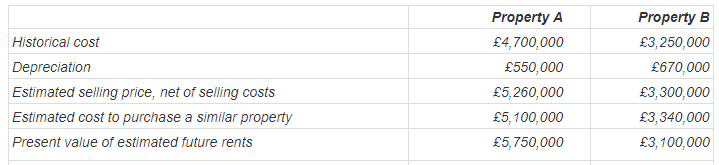

Arlington Property Ltd. owns two large properties that it rents out to tenants on long-term leases. The

Question:

Required:

a. Identify the deprival value of each property

b. Show the ledger accounts to record the revaluation of each property to its deprival value. You may ignore any depreciation for the current year.

c. Does the regular revaluation of property amount to a system of inflation accounting?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: