As the name reflects, Mukand Engineers Limited (henceforth, Mukand) is a Mumbai-based Engineering Construction company. Neelkanth was

Question:

As the name reflects, Mukand Engineers Limited (henceforth, Mukand) is a Mumbai-based Engineering Construction company. Neelkanth was holding a few equity shares of the company and was not happy with its share price movements. Almost every day he would look at his portfolio at moneycontrol.com and observe that the share prices of Mukand had reached some sort of a steady state. Mukand was part of “Bajaj Group.” The promoters of the company i.e., Bajaj Group owned nearly 54% stake inside the company. The stake was held primarily through two group affiliate firms i.e., Mukand Limited 32% and Jamnalal & Sons Pvt. Limited 11%.

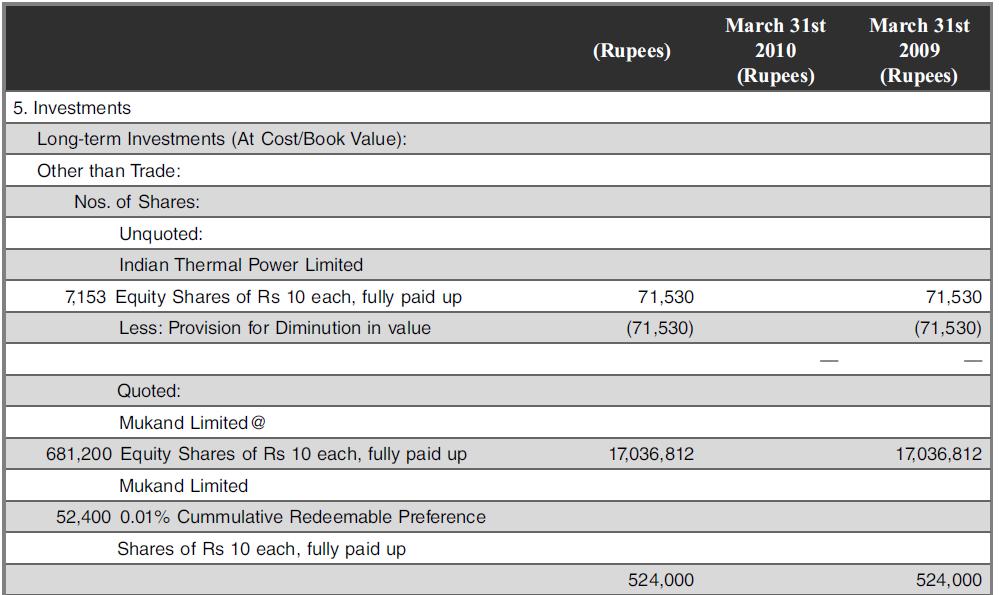

One fine day, Neelkanth’s wife, Vijaya Lakshmi received the mail for the day and it included the FY2010 annual report of the company. The standalone FY2010 balance sheet of the company showed the book value of investments as ₹176 lakh, same as the previous year. Neelkanth, being a vela, then went to the relevant schedule of investments and found the following:

Notes:

1. Market value of quoted investments as at 31-03-2010 ₹45,260,500, as at 31-03-2009 ₹15,727,336

2. All the above investments have been classified by the Company as “Long-term Investments” in view of its intention to hold the same on long-term basis. Pledged as collateral security against working capital facilities availed from Central Bank of India.

Neelkanth’s eyes lit up after looking at these numbers – he was convinced that there was lot of value in the company waiting to be unlocked. He started imagining how the shares prices of his investments will shoot up once the stock markets reflect the unlocking of value. Suddenly, Vijaya Lakshmi took away the annual report from his hands. A surprised Neelkanth shouted at her and she came back stating that her needs for Mukand’s annual report were more urgent – as she wanted to use it to plug the leakage from the drainage pipe. She further argued that Mukand Engineering never performed well and this company’s shares were only worth plugging drainage and started cribbing about the poor stock performance of the company.

(a) Whom would you side with – Neelkanth or Vijaya Lakshmi? Why? Discuss.

(b) Based on the discussion given in the chapter, what would be the accounting treatment for these figures mentioned above? Will you like to make any changes – discuss and suggest.

(c) Identify the few that are applicable to the case above. Is the treatment meted out – appropriate or not? Does the same change – if we try to implement the relevant IAS (part of IFRS) in the above situation? Discuss and comment.

(d) From a promoter-owners perspective, what do you think – these investments might be reflecting for them? How does this differ from Neelkanth’s or Vijayalakshmi’s views on the company? Will the unlocking of value even happen? Comment.

Step by Step Answer:

Financial Accounting For Management

ISBN: 9789385965661

4th Edition

Authors: Neelakantan Ramachandran, Ram Kumar Kakani